AWARD WINNING

Performance Reporting for Endowments, Foundations, and Pensions

Performance Reporting for Endowments, Foundations, and Pensions

Build a Better Investment Strategy With a Platform Delivering Unmatched Data Accuracy

Achieving the returns required to meet the financial needs of your endowment, foundation, or pension fund is not easy amidst market volatility, inflation, and other factors. Fulfilling current obligations while preserving capital for the future requires a performance reporting platform that supports optimal decision-making with accurate and timely data.

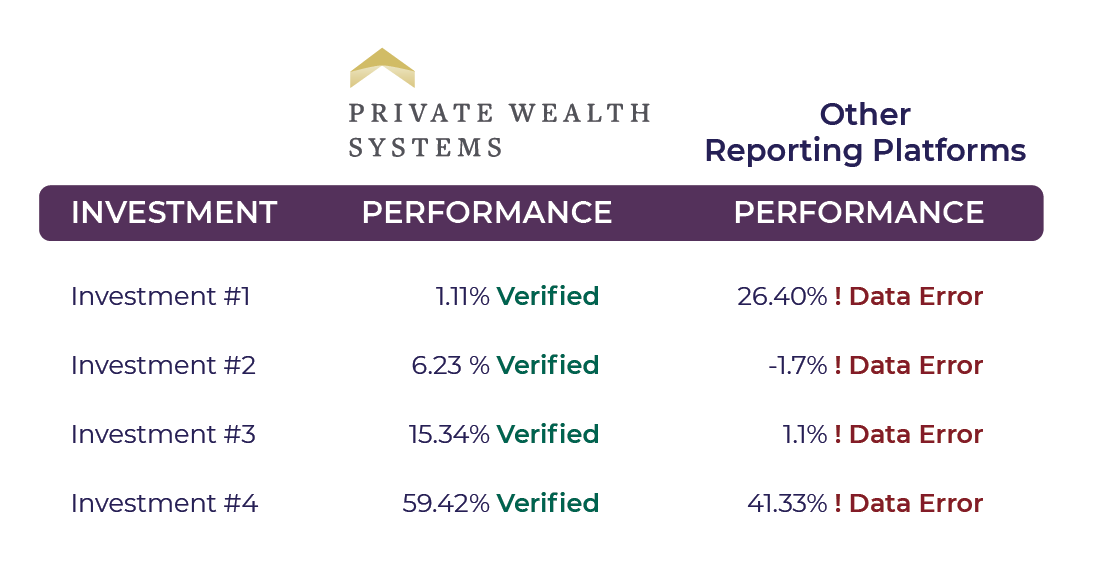

Most reporting solutions fail to meet this basic need because the data feeds they rely on can have daily error rates as high as 18%. The PWS reporting and data platform provides the accurate analytics and data required to build an optimal investment strategy while giving your stakeholders the transparency and clarity they demand.

INCOMPARABLE DATA

ACCURACY

- Performance calculations based on daily time-weighted returns ensure you have a precise picture of investment strategy success.

- Transactions calculated using cost basis versus position-level data provide the highly accurate information required for planning and risk management.

- Data from 40+ bespoke custodial feeds is reconciled daily against the prior day’s data to validate accuracy as well as detect and correct errors.

- Quantity, Price, Transactions, Market Value, Cash, Interest/Dividends, Accruals, performance, Cost Basis

- PWS is a true multi-currency solution

ADVANCED DATA AGGREGATION & DATA ACQUISITION

- Get a complete view of all assets and enable accurate performance calculations for any time period with daily, transaction-based data aggregation down to the tax-lot level.

- Support data acquisition and reporting for non-traditional asset classes including hedge funds, private equity, venture capital, real estate, loans and currencies.

- All data acquisition is conducted using internal PWS resources to ensure the highest levels of oversight and quality.

- Data Normalization / Standardization – Pricing, corporate actions and all referenced data are normalized across every asset across all portfolio’s/accounts

- BPO – data acquisition: PWS

SOPHISTICATED PERFORMANCE ATTRIBUTION

Fully understand portfolio performance drivers with attribution analysis based on numerous metrics including:

- Asset allocation

- Asset class

- Country

- Geography

- Manager

- Sector

- Style

- Mandate

- Currency

- Strategy

COMPLETE

TRANSPARENCY

- Monitor and manage expenses effectively with complete fee transparency.

- Track target vs. actual performance, asset allocation and cash availability.

- Identify opportunities and mitigate risks with real-time visibility into investment performance.

- A comprehensive view into granting and gifting histories enables endowments and foundations to easily track fund allocations and provide donors with insight into how their contributions are being used.

- Bifurcated Security Master that enables customized asset classification without (disrupting / overwriting) standardized asset level details (i.e. Asset Class, Strategy, Sector, Style, Mandate, Region …etc.)

IMPROVED DECISION-MAKING & FLEXIBILITY

- Simplify and expedite decision-making by modeling and analyzing traditional securities and alternative assets on one platform.

- Build a more effective investment strategy with real-time insights into performance, risk, liquidity, cash management, and much more.

- Create custom dashboards to meet portfolio presentation requirements for board members and other stakeholders.

- Efficient reporting for all stakeholders, customized communication, and reporting flexibility for internal investment teams through external stakeholders.

COMPREHENSIVE GIPS COMPLIANCE

- Support compliance with current and future global investment performance standards with multi-currency and multi-lingual GIPS® Composites management functionality.

- Streamline compliance management by automating your GIPS composite reporting process.

In 2022 the PWS platform corrected over $283 million in bank data feed errors.