AWARD WINNING

Investment Advisor Performance Reporting Platform

Investment Advisor Performance Reporting Platform

Elevating the Investor-Advisor Experience With Mass-Personalization at a Global Scale

Curate Personalized Client Experiences

Automation and Scalability to Grow | Customizability and Flexibility to Demonstrate Your Differentiation

Get a closer look at our award winning platform.

Our Investment Advisor Performance Reporting platform provides advisors with summary to transaction level views regardless of complexity, investment type, ownership structure or global jurisdiction. Our consolidated reporting approach empowers your operation from end-to-end, including:

Account Aggregation

We built and maintain our own library of direct, trade-date, connections to banks across the Americas, EMEA and now Asia.

Reconciliation

Bank feeds average an 18% error rate per day. Our system captures and corrects data that other systems cannot. Our reconciliation, including corporate action processing, is global (one-and-done) delivering operating scale that remains unmatched.

Performance Calculation

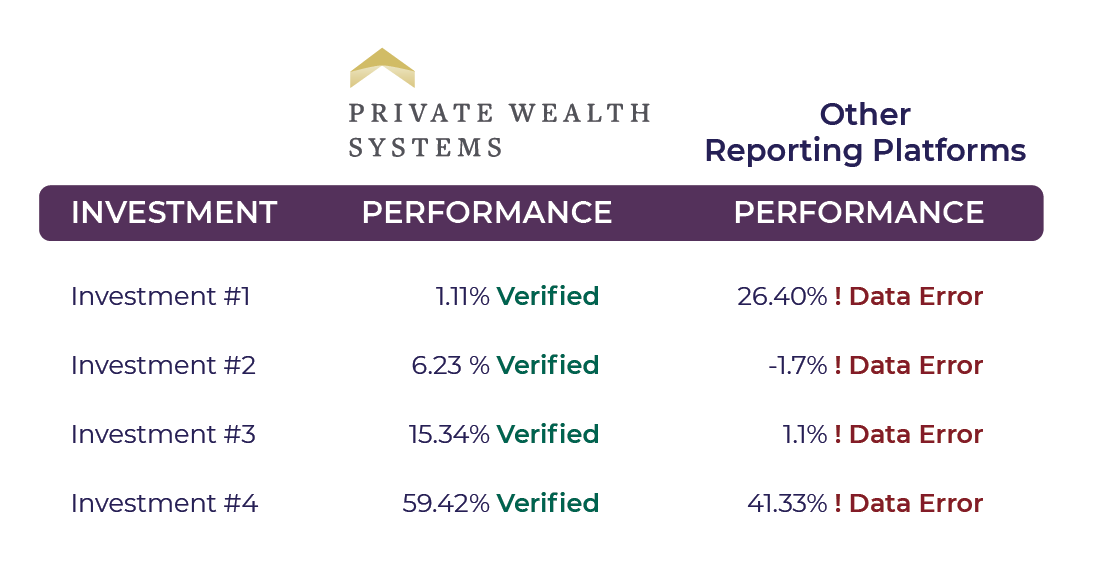

Our transaction-based platform allows for true daily time weighted and IRR performance for better analytics and decision making. Errors in performance can lead to regulatory and reputational risk.

We Have Proven…

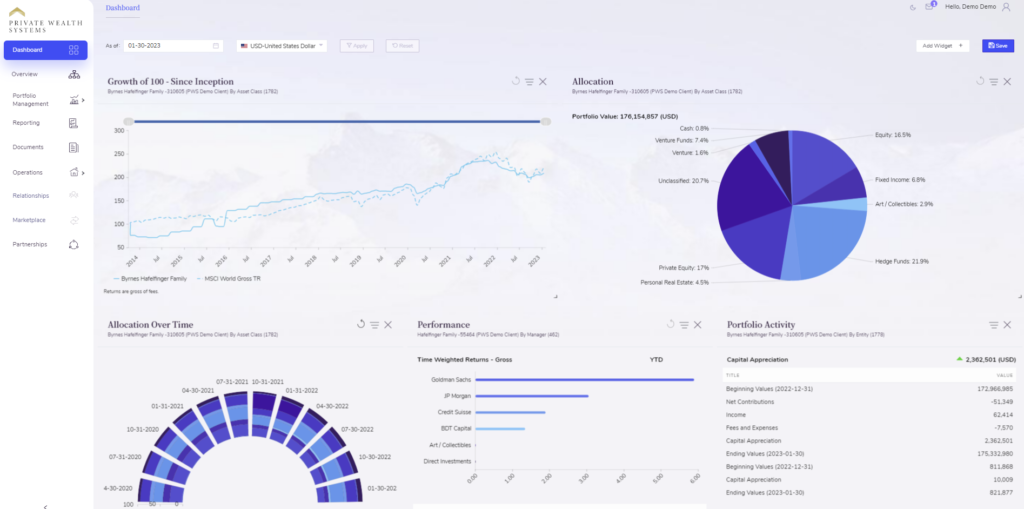

Each individual user can classify, group, structure, and format their data any way they want. True limitless flexibility in order to analyze and manage sophisticated wealth on personalized terms.

With our integrated custom report builder, users can build their own reports with drag-and-drop visualization for digital and PDF-print. Select from our report library including performance, allocation, alternative investments, allocation over time, target and range, policy drift, risk and return, top holdings, gain/loss, fees, activity, income/expense, and more. Drag and drop any widget to any position on the report, and then customize each widget by selecting a portfolio (grouping of data), selecting a model to view/structure that data, and time series.

When finished, create and auto-schedule a complete client investment report package with ease, giving you enormous operating scale with the highest level of personalization so everyone can view and analyze their data on their terms.

Financial data is often riddled with errors. We find and correct those errors where other systems do not. Our data accuracy remains unmatched and has become part of our reputation for excellence.

Private Wealth Systems CEO, Craig Pearson, CFA

Exclusively Designed to Meet the Exacting Needs of the World’s Most Sophisticated Investors and Their Advisors

-

Tell the Story Your Way

Leverage the flexibility and customizability to visualize the investment strategy your way, telling the story exactly the way you want to your investor clients. -

"Powerful Yet Easy to Use"

This client testimonial echoes our commitment to leading our industry in delivering client experiences unlike any other so all users, regardless of experience, can actively gain control over financial complexity. -

Timely Data

Our dashboards and reports are always up-to-date so they are relevant and actionable, providing you the most accurate decision-making potential. -

Secure & Private

As a preferred partner to several of the largest private banks and accounting firms we are required to maintain the highest levels of cyber and operational security.

-

Design That Delivers Differentiation

Our reporting and dashboard design has been called the most intuitive in the industry, driving high client satisfaction among investor users. -

A 100% Total View of Wealth

We provide the most complete picture of your total wealth, including public and private investments, personal holdings, and bank loans, to ensure the most informed decision making. -

Unparalleled Data Accuracy

In side-by-side comparisons with competing systems we demonstrate our differentiation of data accuracy, powered by our direct data feeds and proprietary auditing algorithms, to deliver peace of mind in your analysis. -

Global Operating Scale

From processing corporate action events and calculating accruals to correcting bank errors, our platform supports over 8.3 times more transaction volume per person than competing systems, delivering the lowest total cost in the industry.