In 2022, our reconciliation platform corrected over $283 million in errors from bank data feeds. This ensured our family office clients had peace of mind when analyzing and acting upon their financial data to protect their generational wealth. Research has shown bank data feeds can have daily error rates as high as 18%.

Errors range from mispricing securities, not processing corporate actions correctly, not updating private equity valuations based on cashflows, and not correctly processing cash and security transactions. These errors impact liquidity, performance, analytics, gain/loss, and income/expense, which can lead to a devastating impact when managing complex investment portfolios.

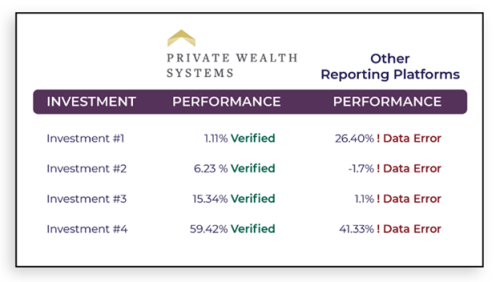

REAL-WORLD EXAMPLES OF REPORTING PLATFORM INACCURACIES

The following real-world examples, from family offices using other reporting systems, highlight the importance of using an investment performance reporting platform that is built to be your financial firewall and provide the industry’s most accurate data with global scale.

“On the investor statements [competing reporting platform] is off by 230 bps at 13.4% inception to date (ITD) internal rate of return (IRR). Good to know someone can get it right.”

Other reporting systems don’t calculate IRR or daily time weighted (DTW) correctly. They rely on modified versions of performance which can produce material misrepresentations of true performance, which increases regulatory and reputational risk as well as misinformed decision making.

“Why does [competing reporting platform] not show performance when there is a late posted dividend transaction? I had to manually change the posted date to get correct performance.”

Other performance software can’t manage accruals separately, forcing manual corrections that increase costs and reporting delays.

“Yes, this is something that Private Wealth Systems does on a fundamental level that [competing reporting platform] cannot do. This provides much cleaner data because it covers unrealized gain/loss, tax lots, and performance calculations.”

This is the power of a unified security master, which improves data accuracy with minimal manual intervention.

Reporting platform ‘MUST-Haves’ that ensure data accuracy and operational scalability

The following four features are required to deliver tax-level accuracy with the highest level of operating scale. Better data requiring fewer people gives you peace of mind at the lowest total cost.

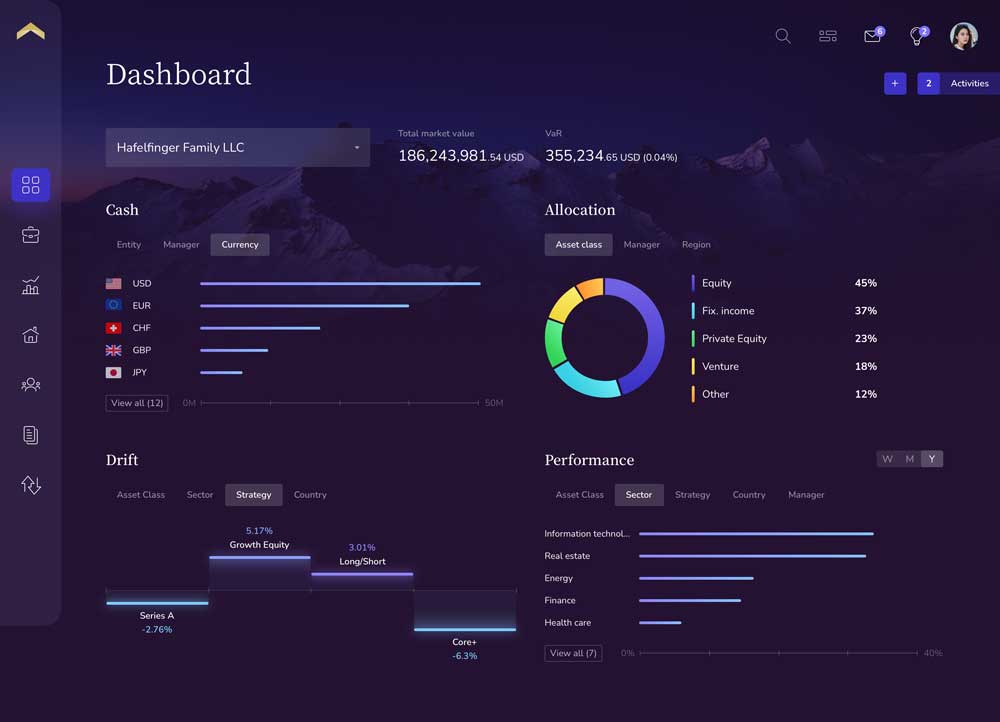

A dual-investment ledger

Your reporting platform should have an investment ledger that runs in parallel with every bank and manager to perform start-of-day, transaction-based reconciliation on your behalf. This ensures all the data you are accessing through your reporting platform is error-free. Without an investment ledger a reporting platform cannot reconcile data.

A unified security master

If you have an investment at multiple custodians does your reporting system show a single identifier with a single price, or multiple identifiers with different prices for that same security? A “unified security master” creates a single instance of an investment with a single price, single corporate action processing which is required in order to perform daily reconciliation and accurate manager-to-manager analysis on risk, return, liquidity, and gain/loss. Some banks can have errors as high as 10% on any given day for the same holding. Without a unified security master, you cannot auto-reconcile driving up error rates and total cost.

The ability to build positions from transactions

The vast majority of reporting systems show and report transactions, but they can’t build and manage positions from these transactions. This forces other systems to simply use the positions provided by the custodian bank feed. Because they are not able to perform any type of reconciliation based on individual transactions performance will be inaccurate and tax-lot level analysis will be error prone.

A centralized operations team

Does your reporting provider perform start-of-day reconciliation and process corporate actions for you or are you required to use your own team or a 3rd party to make adjustments for each individual account? For example, if IBM were to spin off NewCo today, would your provider automatically adjust IBM and NewCo across all custodians? Selecting a reporting provider with a centralized operations team that performs these adjustments for you enables you to focus on growing your wealth instead of administrative tasks.

PROVEN TO provide unrivaled data accuracy

Don’t let inaccurate reporting destroy YOUR family wealth

The CEO of a family office recently said, “The point of technology is to drive scale, getting better data with fewer people. A large support team is like using a band-aid to cover a bullet hole, it’s not sustainable.”

For ultra-high-net-worth individuals (UHNWIs) inaccurate reporting can lead to decisions that can destroy family wealth. It’s time to take a closer look at the data health behind your financial reports and demand more from your providers.

Private Wealth Systems’ innovation in family office technology has earned numerous peer-based industry awards – including three awards in 2023 for best family-office reporting. The company has also earned the trust of the largest and most sophisticated family offices, UHNWIs, private banks, and accounting firms in the world.