According to a recent survey from Citi Private Bank (Global Family Office Report 2023), 68% of families stated their top concern was “preserving the value of their assets”, a noticeable shift from the previous year where families stated their top priority was “preparing the next generation to be responsible wealth owners”. This is a clear signal to family offices that risk/financial loss is paramount and strategies for wealth preservation will perhaps be under closer scrutiny than in years past.

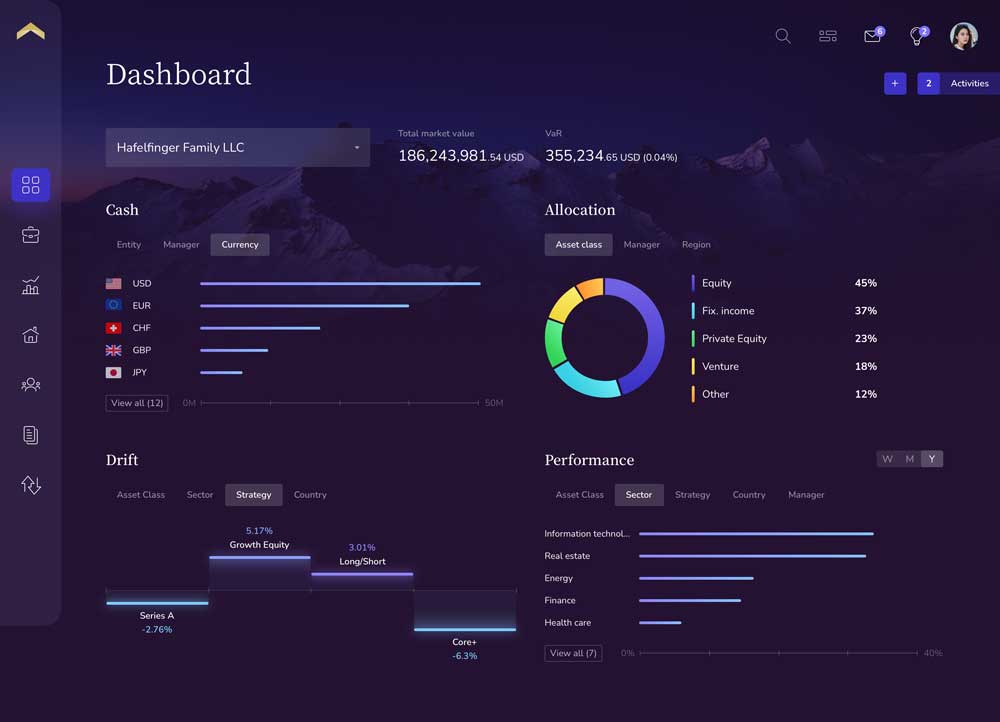

Many UHNWIs built their wealth over the past decade during a bull market. Easy gains provided easy comfort with few focusing on risk management or fear of losing their family’s legacy wealth. Now that market volatility is increasing and there are talks of a recession and possible bear market, many family members do not have the transparency and visibility they need to make informed decisions to preserve their family’s wealth. Ask yourself: Do you know which of your investment managers are performing well and which are not? Are you too heavily invested in growth equity strategies or high yield securities? Do you have an independent and unbiased view into your investment managers performance, fees, and risk? And do you have an easy comparison across all of your managers?

Do you know which of your investment managers are performing well and which are not?

THE RISKS ARE REAL

In a recent real-world example, an UHNWI with over $430 million used Private Wealth Systems’ intelligence platform to learn one of their trusted investment managers was contributing to more than 80% of the family’s negative portfolio performance compared to the other 6 investment managers working with the family. The underperforming manager also took the greatest amount of risk and was charging the highest amount in fees. Left unchecked, this single manager could have wreaked havoc on the family’s wealth over time.

Left unchecked, this single manager could have wreaked havoc on the family’s wealth over time.

A second example involved a family office paying over $1 million in fees to a manager that was underperforming the market…by double digits! Here again, without clear, independent visibility into the manager’s activity, the family could easily have experienced significant loss in wealth.

IT’S NOT ALWAYS CLEAR

Investment managers take great effort to use their client reporting as a way to highlight positive activity. It’s not often that a manager tells a client they underperformed, took a lot of risk, and charged a lot of fees. This is why it’s so important for ultra high net worth investors to have an independent, unbiased view and analysis of their managers and their investments. You may be amazed at what you discover.

It is crucially important for wealth owners to have immediate access to key performance indicators of their investment portfolios, and managers alike. It is not just about tracking profits and losses; it’s about spotting vulnerabilities and addressing risks preemptively.

IT’S TIME TO PUT THE POWER & CONTROL BACK IN YOUR HANDS

Private Wealth Systems (PWS) has transparency infused into its philosophy, and its platform. The company’s groundbreaking consolidated investment reporting gives UHNW wealth owners the tools, independent transparency, and control they need to drive informed decision-making. It’s at the heart of the company’s core philosophy, borne from firsthand experience and a commitment to help wealth owners avoid the loss of their family’s legacy wealth.

PWS was designed to serve as your digital financial quarterback, providing impartial and customized analyses to safeguard your family’s wealth. With PWS, a single click can help you quickly identify potential areas of vulnerability and answer key questions, like:

Which of your investment managers are performing well and which are not?

Are you overly invested in growth equity and large-cap stocks, especially as the economic cycle matures?

What is your exposure to specific sectors, investment styles, or strategies?

Do your investments align with ESG and socially responsible principles?

In addition, PWS empowers you to take decisive action. Gone are the days of passive wealth management, where underperforming managers go unaddressed, gradually eroding your family’s financial security. With PWS, you have the knowledge to promptly replace underperforming managers, protecting your wealth from further decline.

In today’s dynamic market conditions, the stakes are higher than ever for UHNWIs. Preserving and safeguarding your family’s wealth hinges on gaining insights into investment performance, risk and fees, a task made possible with Private Wealth Systems.

As stewards of prosperity, it is crucial for UHNWIs to embrace tools and strategies that ensure the enduring legacy of their families. In the pursuit of wealth protection, knowledge is indeed power.

To learn more about PWS, please visit us online and schedule a demonstration of our 6 time award-winning platform.