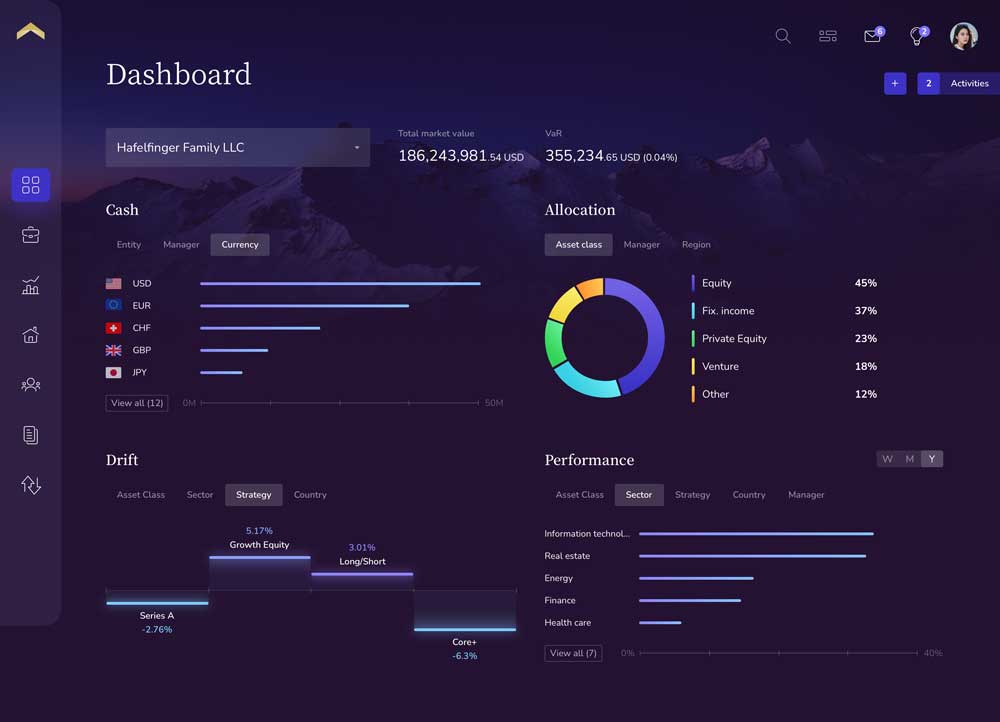

As we enter 2023, portfolio data aggregation continues to be a source of frustration for ultra-high net worth individuals (UHNW) and family offices. Continued market volatility combined with the innate complexities in managing a multi-asset class portfolio makes getting an accurate view of the portfolio extremely challenging. To be successful long-term, family offices would benefit from rethinking their approach to technology and how they handle data aggregation and portfolio reporting.

The 2022 North America Family Office Report asked leaders of family offices to share their biggest priorities for the year. Despite inflation and economic uncertainty, 58% of family offices want to find new investment opportunities, 49% are looking into alternative investments, and 28% want to diversify their portfolios. In addition, 33% report a rise in staff numbers, 26% are outsourcing more functions to service providers, 35% are increasing their number of risk management measures/structures and 46% percent are improving IT infrastructure.

Transforming your family office’s efficiency, agility and performance to address these priorities require operational improvements supported by the right UHNW portfolio management technology and process framework.

When you are a small or mid-sized family office, process frameworks and new technology can feel overwhelming, too structured and possibly too expensive. But do not let that mindset get in the way of considering improvements for 2023.

Here are some tips to get you started on building a family office framework that will support more efficient portfolio management and more effective investment decisions.

Step 1 – Understand your biggest challenges and identify areas most in need of improvement. Here are some questions to consider in evaluating your portfolio management process:

- How much time do you spend aggregating and validating investment data?

- What do you like about current processes and technologies? What do you dislike?

- What does investment reconciliation look like?

- How often do you intervene to correct investment data manually?

- Does portfolio data integrity come into question?

- How long does it take you to produce portfolio reports?

- Are your wealth owners and family members hands-on and detailed or do they just prefer high-level overviews?

- What portfolio management processes do you wish you could automate or improve?

Exploring these questions will likely uncover significant areas for improvement.

Step 2 – Assess your current technology. Many family offices rely heavily on custodial data or accounting systems – neither of which is designed to meet the challenges of managing complex UHNW portfolios. Using accounting, finance and custodial platforms to manage private investments is not viable. These technologies were built to handle different financial needs and lack the native infrastructure needed to achieve a holistic and accurate view of your multi-asset class portfolio. When you have to manually aggregate and validate investment data and feed private transactions into the system, reporting can take weeks or even months to populate. This results in inaccurate or outdated portfolio reports.

Consider the technology you currently have in place – is it really meeting your needs holistically? Does it provide the on-demand, accurate, single source of truth you need across your multi-asset class portfolio?

Step 3 – Stop letting limitations hold you back. When your team must work within the limits of your existing technology, it becomes detrimental to productivity and accuracy. It is likely your team is spending more time on administration tasks related to data aggregation and reporting than they would like.

How many people are dedicated to aggregating, validating and correcting investment information? Imagine if you had technology that could automate most of these tasks and produce accurate portfolio reports and interactive dashboards on demand. That would free up high-value resources to focus on more strategic investment evaluation and actual portfolio management and growth.

Step 4 – Explore investing in a portfolio management technology platform uniquely designed for UHNW portfolios. Create a list of your must-have capabilities and explore what the market has to offer. Technology has improved significantly and newer platforms purpose-built for multi-asset class portfolio management are available in an easy-to-deploy software-as-a-service model. Legacy platform providers may seem like the safe bet, but they may not be innately designed to handle your needs – creating more work at a higher cost. So, keep an open mind on more agile, modern technology options that may be newer to the scene.

Step 5 – Create and communicate your family office framework. People can become apprehensive about change. It is vital to explain how the right technology can eliminate the need for teams to manually aggregate, validate and report on portfolios. Technology can resolve and handle nuanced and manual work with minimal human intervention. Optimized processes supported by sophisticated UHNW portfolio management technology can free up your team to work on more strategic activities.

With a new and improved family office framework in place, you have the tools to finally achieve a single view of your portfolio across both public and private assets – enabling better, more informed investment decisions to drive long-term portfolio sustainability and growth.

This article was originally written by Private Wealth Systems for the Family Office Exchange blog.