AWARD WINNING

Family Office Portfolio Management & Reporting

Family Office Portfolio Management & Reporting

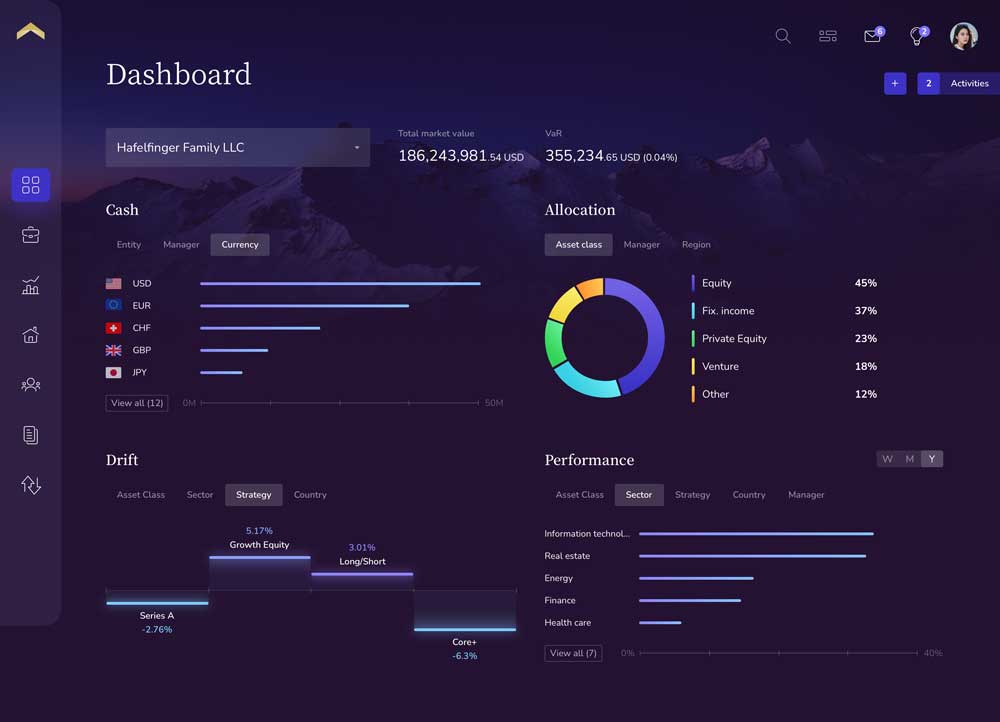

Uniquely Designed to Meet the Exacting Needs of the Most Sophisticated Investors in the World

Your trusted single source of truth for 100% of your total wealth

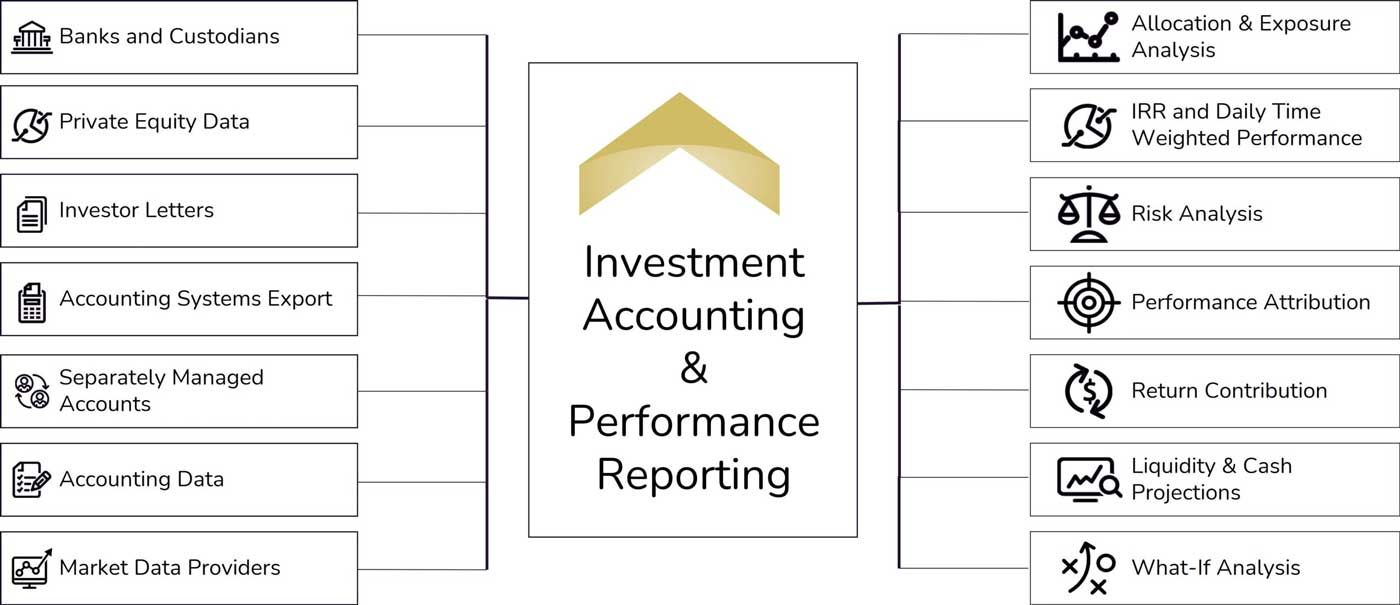

AGGREGATION

RECONCILIATION

ACCOUNTING

CONSOLIDATED REPORTING

PORTFOLIO MANAGEMENT

Get a closer look at our award winning platform, delivering unparalleled accuracy.

Trusted by leading family offices across 5 continents, Private Wealth Systems’ award-winning family office portfolio management and reporting platform delivers summary-to-transaction level analysis across every asset class, ownership structure, and currency for the fastest and most informed decision making to preserve wealth.

As the only platform that blends the power and accuracy of a multi-asset investment accounting ledger with the total flexibility of a portfolio reporting platform, we have earned our reputation for excellence in delivering the trusted view for sophisticated investment portfolios with the security, speed, and accuracy you demand.

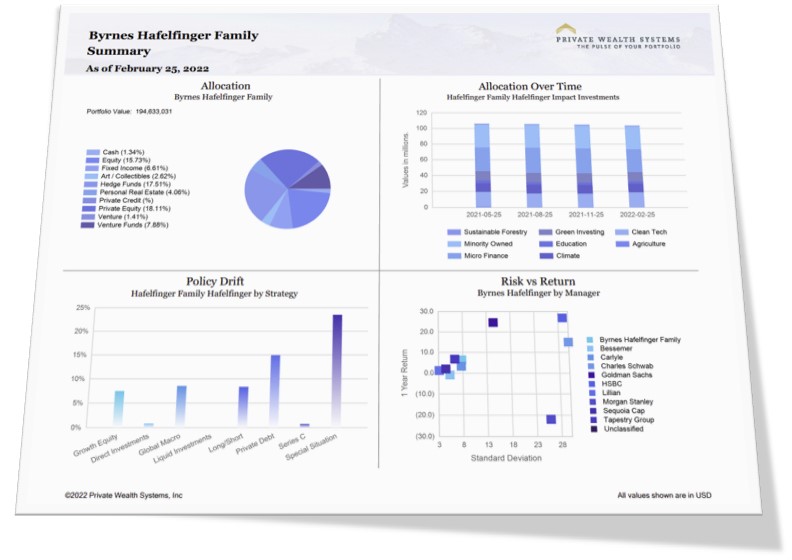

A Consolidated View Across All Asset Classes & Ownership Structures

EQUITIES

PRIVATE EQUITY

FIXED INCOME

HEDGE FUNDS

REAL ESTATE

VENTURE

LOANS

ART & COLLECTIBLES

What are family offices saying about us?

It has everything from a reporting standpoint that you would ever need.

It saves time through direct feeds from banks/funds.

We can perform analytics, review and change allocations and asset classes.

Their platform delivers growth potential with minimal investment.

It allows us to monitor and comply with industry rules and regulations.

All of our data is in one place, with easy access; it’s much more efficient.

Their focus is on the needs of a family office.

We liked their first-hand knowledge, thoroughness. They asked the right questions.

Designed for the Unique Needs of Complex Family Offices

-

A 100% Total View of Wealth

We provide the most complete picture of your total wealth, including public and private investments, personal holdings, and bank loans, to ensure the most informed decision making. -

Unparalleled Data Accuracy

In side-by-side comparisons with competing systems we demonstrate our differentiation of data accuracy, powered by our direct data feeds and proprietary auditing algorithms, to deliver peace of mind in your analysis. -

Global Operating Scale

From processing corporate action events and calculating accruals to correcting bank errors, our platform supports over 8.3 times more transaction volume per person than competing systems, delivering the lowest total cost in the industry.

-

Secure & Private

As a preferred partner to several of the largest private banks and accounting firms we are required to maintain the highest levels of cyber and operational security. -

Powerful Yet Easy to Use

This client testimonial echoes our commitment to leading our industry in delivering client experiences unlike any other so all users, regardless of experience, can actively gain control over financial complexity. -

Unlimited Flexibility

Every user can easily classify, group, and structure their data any way they want in order to view and analyze their wealth the way they want, when they want to make decisions that are personalized and relevant regardless of role.