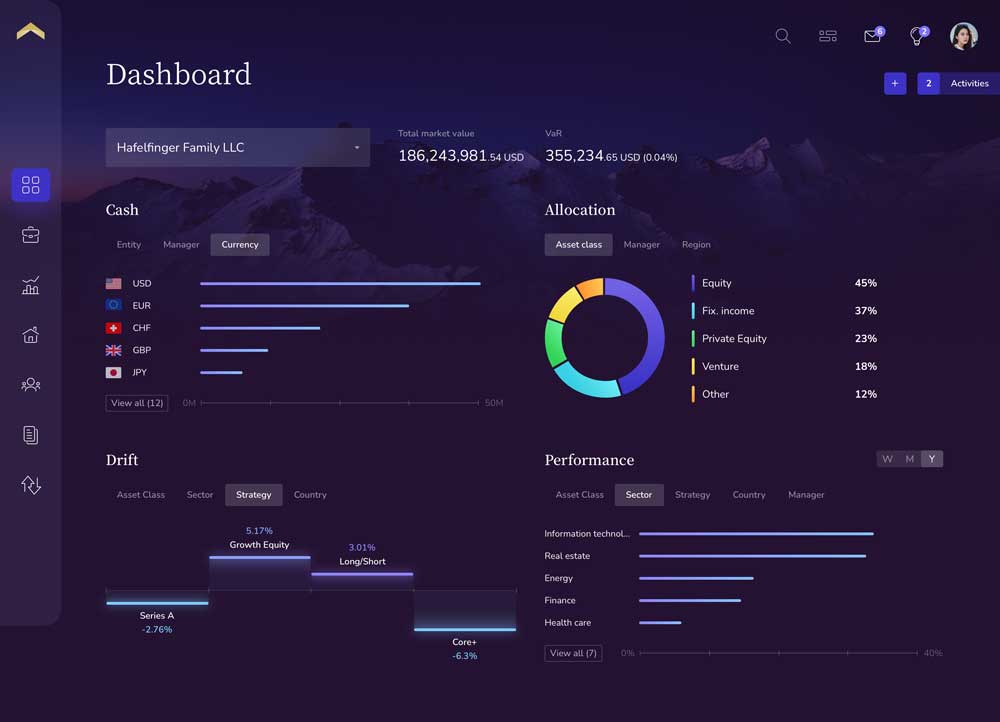

One complaint we frequently hear from UHNW individuals and family offices is that most portfolio management technology platforms only report on settlement date – not trade date. This methodology frustrates operations and investment teams alike because it makes it difficult to accurately report on liquidity, exposure and risk for the date the trade was made.

If you are going crazy trying to properly calculate and report on an asset’s performance, you’re not alone. Custodial data calculations shouldn’t create more work for you.

Watch our latest episode of The UHNW Portfolio Management Pet Peeve of the Day video on “The Trade Date vs. Settlement Date Dilemma” now.

Our UHNW Portfolio Management Pet Peeve of the Day video series touches on some of the most common pet peeves we hear from UHNW investors, family offices and private banks. We offer tips on how to improve your portfolio management technology and process framework to set a new, better standard for portfolio data accuracy. If you’re interested in seeing more from the series, watch our other videos: “IRR Calculations,” “Lack of Investment Reconciliation,” “Data Normalization Errors,” “Private Investments on Custodial Platforms,” “Manual Intervention to Fix Inaccuracies,” and “Inaccurate Performance Calculations.”