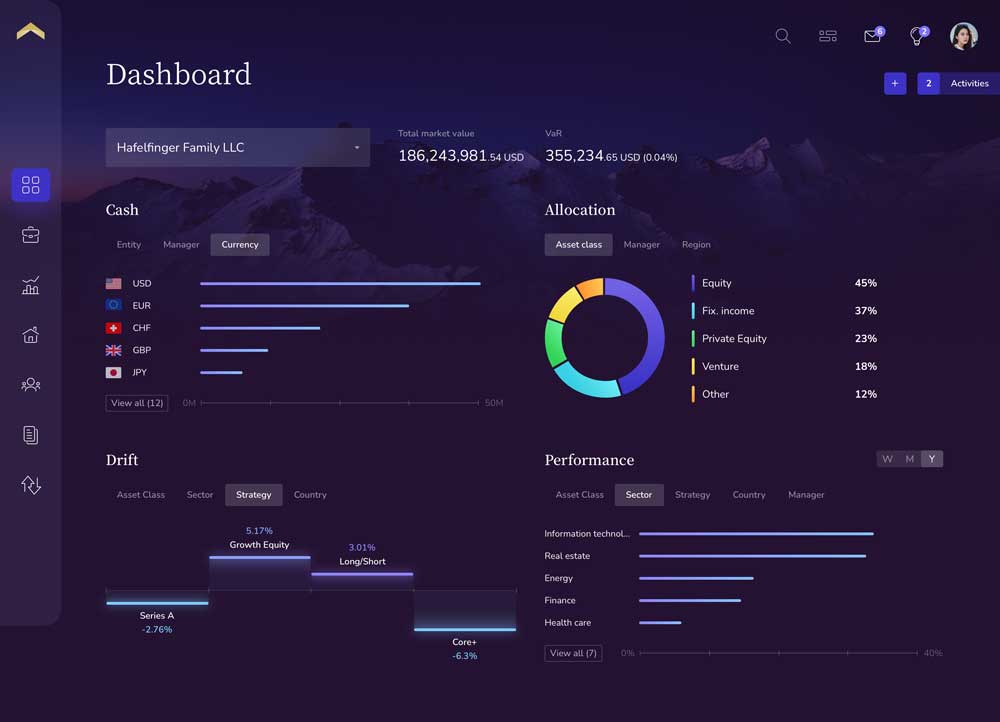

If you are a member of an ultra-high net worth (UHNW) investment or operations team, how often does a wealth owner come to you asking for investment information and how quickly are you expected to produce the reports? Our guess is they come to you often and they expect immediate access to information. But if you’re leveraging asset-class specific systems or accounting software, accurate portfolio reporting is not always easy. An all-hands-on-deck approach to aggregate, validate and report on investment data is typically how family offices and private bank teams respond to a wealth owner’s request.

In our latest installment of the “UHNW Portfolio Management Pet Peeve of the Day” video series, we explore how UHNW portfolio management technology helps eliminate manual intervention in portfolio reporting and restore trust in the integrity of portfolio data.

Our UHNW Portfolio Management Pet Peeve of the Day video series touches on some of the most common pet peeves we hear from UHNW investors, family offices and private banks. We offer tips on how to improve your portfolio management technology and process framework to set a new, better standard for portfolio data accuracy. If you’re interested in seeing more from the series, watch our other videos: “IRR Calculations,” “The Trade Date vs. Settlement Date Dilemma,” “Data Normalization Errors,” “Lack of Investment Reconciliation,” “Private Investments on Custodial Platforms,” and “Inaccurate Performance Calculations.”