Whether you are an UHNW investor or a member of a family office or private bank investment team, attempting to manage private investments on a custodial platform leads to a whole host of frustrations. The issues are the result of trying to manage different asset types using a custodial platform that was not specifically built to address the complexities of private investments.

Custodial platforms were built as accounting systems and are generally focused on cash flows. They lack the native infrastructure needed to deliver an accurate view of private investments. While they can account for a private investment transaction, custodial systems may not populate the correct investment data for weeks or even months after the transaction. This results in an inaccurate view of overall portfolio performance, exposure, liquidity and risk, as well as possible inaccuracies at the asset holding level.

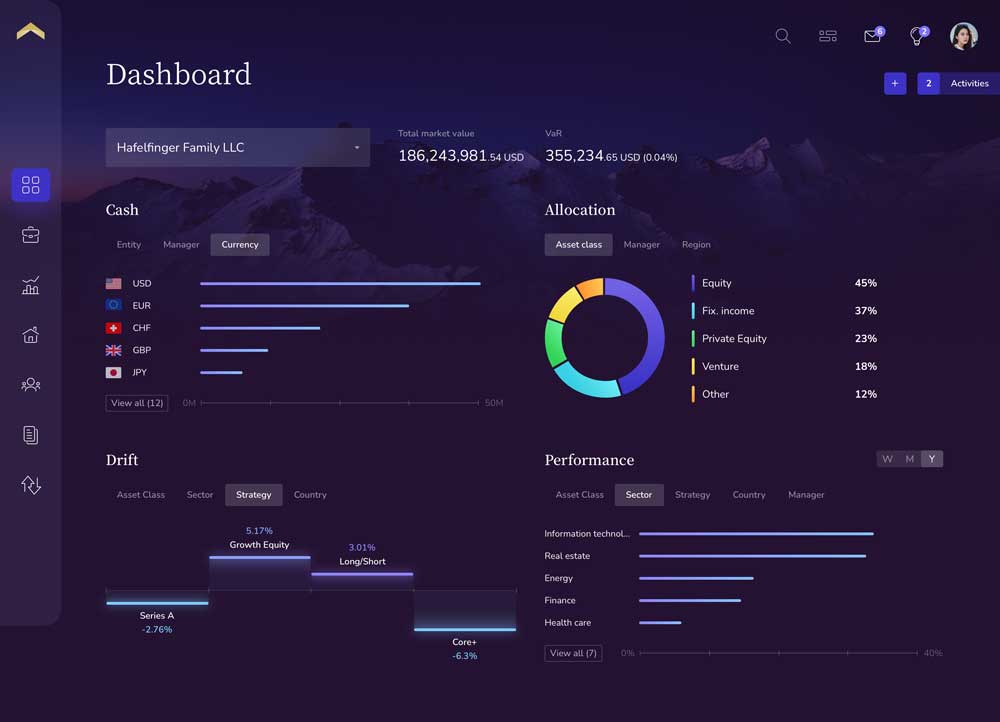

The Private Wealth Systems UHNW portfolio management platform was purpose-built to address the complexities of private investments and sync seamlessly with custodial platforms to deliver an accurate picture of your entire investment portfolio. In our latest UHNW Portfolio Management Pet Peeve of the Day Video, “Private Investments on Custodial Platforms,” we share insights on technology and process solutions to help you achieve more accurate reporting on private investment data.

Our UHNW Portfolio Management Pet Peeve of the Day video series touches on some of the most common pet peeves we hear from UHNW investors, family offices and private banks. We offer tips on how to improve your portfolio management technology and process framework to set a new, better standard for portfolio data accuracy. If you’re interested in seeing more from the series, watch our other videos: “IRR Calculations,” “The Trade Date vs. Settlement Date Dilemma,” “Data Normalization Errors,” “Lack of Investment Reconciliation,” “Manual Intervention to Fix Inaccuracies,” and “Inaccurate Performance Calculations.”