There is a growing realization among ultra-high net worth individuals and family offices that when it comes to managing and viewing complex, multi-asset class investment portfolios, the view is flawed. If you were asked today to pull together a single source of truth for all of your investments, including alternative investments like hedge funds, private equity and real estate, what would the process look like? How long would it take to collect the data, reconcile the information and report accurately across the myriad of asset classes? Does this practice involve a financial scramble – pulling information from multiple spreadsheets, disparate systems of record and asset class-specific applications? Would it take days, maybe weeks, to collect and report on your investments? The answer is probably yes – and worse, by the time you pull it together, it is no longer accurate.

Cobbling together spreadsheets, accounting systems and investment data is cumbersome and time consuming. The simple act of collecting and aggregating UHNW portfolio information is a feat in and of itself – and that is just the data. Now factor in the investment strategy once you have finally pieced together a view of your investment world. If several days have gone by, is the information still accurate? Are you making the most informed investment decisions based on a real-time view of your portfolio? Or is your investment decision based on data from weeks prior – not accounting for continually changing shifts in the market?

With multiple asset types, varying report timelines and different data sources, there are a lot of questions about data accuracy, liquidity and risk that UHNW individuals and family offices cannot always answer. Without a real-time, single source of truth, it is difficult to effectively manage a complex investment portfolio. It’s time to start thinking about how you can do better.

Many UHNW individuals and single family offices have grown tired of flawed systems, manual data aggregation and inaccurate or incomplete portfolio reports. Sick of the status quo and tired of the excuses for less-than-accurate investment data, they have started to invest in UHNW portfolio management technology.

UHNW portfolio management technology is different than accounting, financial or investment technology. The technology many UHNW portfolio managers are accustomed to accommodates the needs of the asset class, not the entire multi-asset class portfolio. UHNW portfolio management technology is uniquely designed for UHNW individuals, banks and family offices that want to achieve greater efficiency, accuracy and agility.

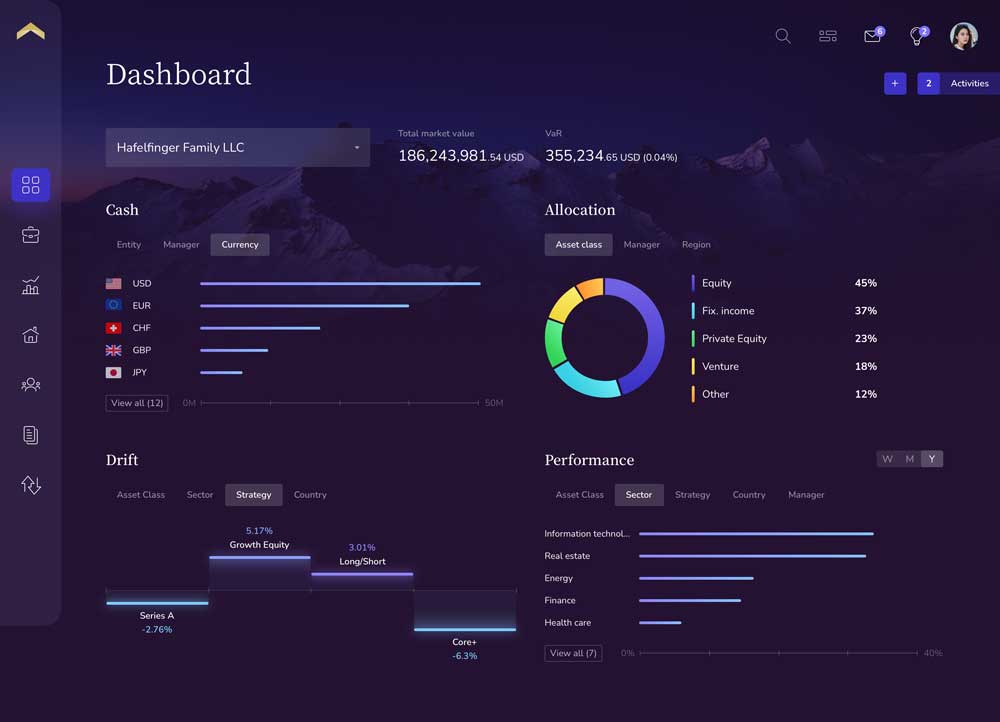

I have seen firsthand the challenges UHNW individuals face when managing the complexities of their investments. However, the struggle does not need to continue. New technology does exist. It’s time to invest in a technology platform that allows investors to aggregate investment data, validate data accuracy, report on multi-asset class portfolio performance and evolve complex investment portfolios over time. The right portfolio management technology platform will allow wealth owners and family offices to seamlessly collect, aggregate and normalize investment data from multiple sources; ensure pinpoint data accuracy with near real-time data reconciliation and validation; gain faster insights through interactive dashboards and quickly generate reports for wealth owners and stakeholders. The benefits include greater efficiency and accuracy, less time spent on administrative tasks and more time to focus on strategic investment analysis, portfolio evolution and growth.

It is no longer acceptable to settle for flawed, inaccurate portfolio reporting. UHNW individuals and family offices need to demand more from their current portfolio management technology platform or find a new partner to help them achieve the single source of truth they need to make smarter, more informed investment decisions.

This article was originally written by Private Wealth Systems for the Wealth Management 2022 Midyear Outlook.