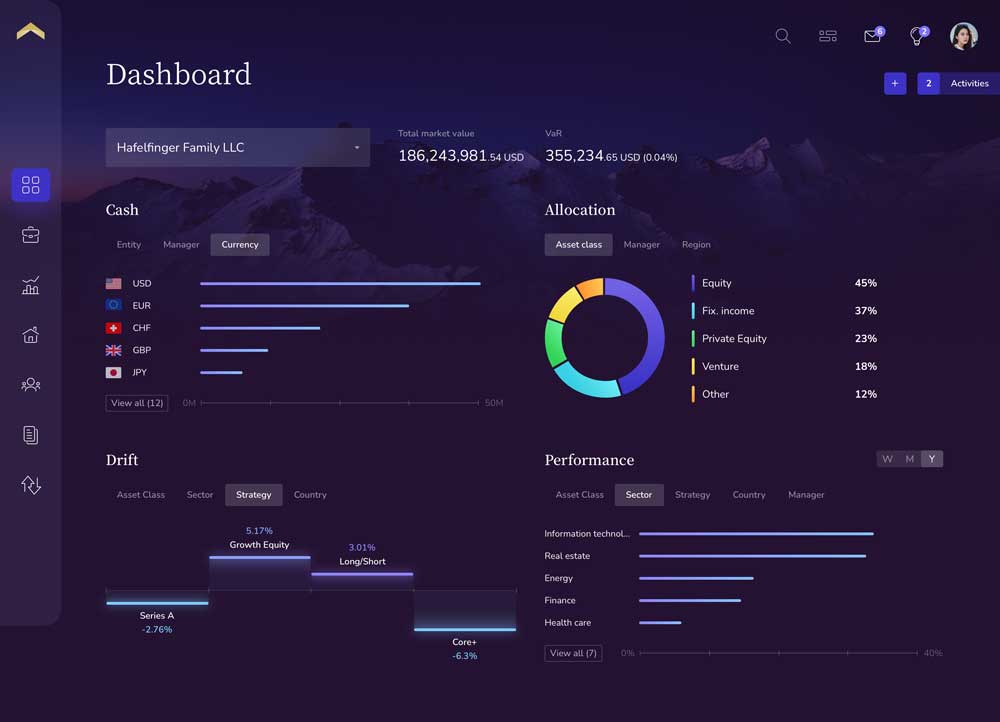

Family offices manage $5.5 trillion in global wealth—but that wealth is under threat. The investment performance paradox is real: investment performance data is abundant, yet dangerously inaccurate — off by as much as 30%. When bad performance metrics meet bad analytics, the result is bad decisions —risking liquidity, misallocating assets, and the very future of your family’s wealth. Are you truly seeing the full picture, or just a dangerous distortion?

Despite the proliferation of sophisticated family office software that is designed to make investment tracking seamless, most family offices unknowingly rely on outdated, flawed methods for calculating performance. If the very foundation of your investment decisions is shaky, how can you truly trust where your wealth is headed?

How Investment Reporting Gets Distorted

Here’s the unsettling truth: Most investment advisors rely on a flawed metric for performance. The Global Investment Performance Standards (GIPS) explicitly states that the method most institutional investment advisors rely on is nothing more than an “estimate of true time-weighted returns (TWRR)”. That means the investment performance that family office software produces and that families and UHNWIs rely on isn’t an actual reflection of portfolio success—just a rough approximation.

Family offices and UHNW investors are often unaware of a critical flaw: they’re unknowingly basing multi-million dollar decisions on distorted performance data. What’s more alarming? There are documented cases where strategies reported as profitable were, in reality, silently bleeding cash. This isn’t just an oversight; it’s a profound risk to your legacy.

The True Cost of “Good Enough” Data: Are You Risking Your Family Legacy?

For family offices, the consequences of inaccurate investment performance are severe:

- Misallocation of Capital – Poor data leads to poor investment choices, locking in losses instead of securing gains.

- Loss of Liquidity – Families may think they have access to funds when, in reality, distorted performance data hides liquidity risks.

- Suboptimal Returns – If performance metrics are off by as much as 30%, how can investors be confident in their returns?

- Unnecessary Risk-Taking– Market volatility and frequent cash flows make inaccurate data even more dangerous.

The Mandate: Precision Over Peril

Family offices must demand precision in performance measurement. That means:

- Asking the right questions – Buyers of family office software must ensure that the system they choose is different and can demonstrate precision in performance reporting.

- Rejecting flawed methodologies – Investment managers should be held accountable for the performance data they present.

- Ask how and why the family office software platform’s performance calculation is more accurate than other systems. Data should be the main differentiator.

- Understand the backgrounds of the architects of the family office software your evaluating. Is there domain expertise in multi-asset, transactions-based time weighted and money weighted returns.

In the world of wealth management, every percentage point matters. The investment performance paradox exposes a $5.5 trillion risk—a threat family offices cannot afford to ignore. To preserve multi-generational wealth, they must ensure their investment managers use accurate data, not outdated estimates. Because when it comes to legacy wealth, precision isn’t optional—it’s everything.