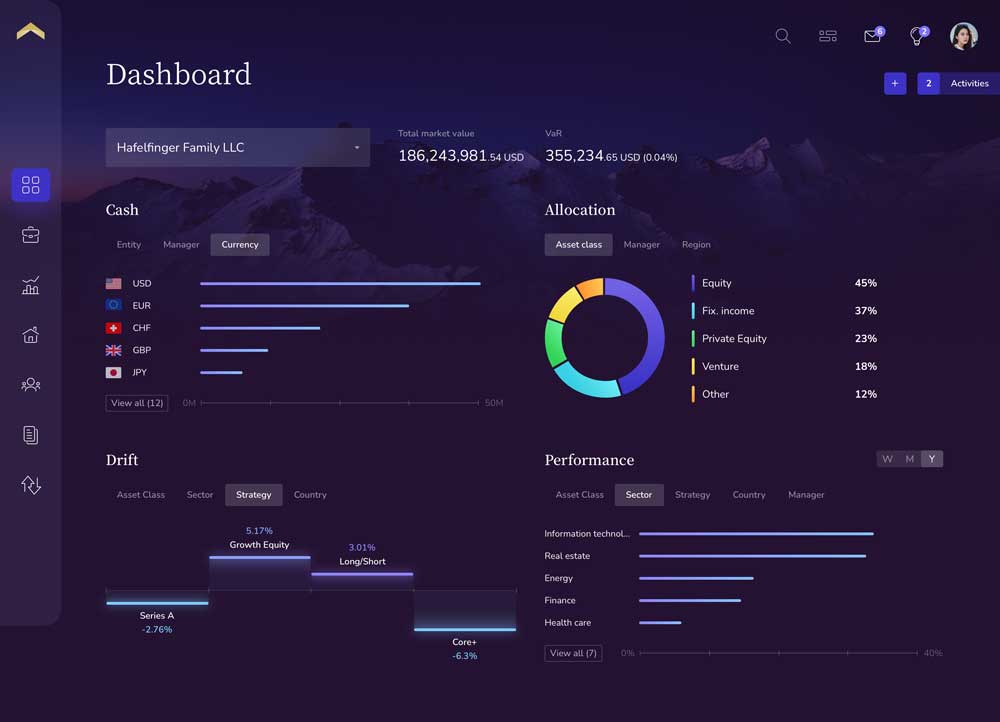

If you are an ultra-high net worth (UHNW) investor or a member of an UHNW family office or investment team, you face continual challenges. Evolving stakeholder demands, erratic market volatility, disparate systems and multiple asset classes are just some of the challenges inherent in UHNW portfolio management. Despite these challenges, UHNW investors, family offices and private banks share a desire to achieve better investment data accuracy, a single view of the entire portfolio and better insight into liquidity, exposure and risk.

Tech-savvy UHNW investors and family offices have grown tired of labor-intensive process inefficiencies and outdated technology systems. They are increasingly adopting technology uniquely designed for UHNW portfolio management and adopting a more unified framework – aggregate, validate, report and evolve – effectively transforming their approach to UHNW portfolio management.

There are three main factors driving tech-savvy investors to ditch the status quo and set a higher bar for portfolio data accuracy.

- Too much time spent aggregating and validating data. If you’re aggregating, reconciling and validating multi-class investment data using spreadsheets or relying on disparate point systems for each asset class, it’s time to invest in new portfolio management technology. Tech-savvy family offices, private banks and wealth owners are saying goodbye to spreadsheets, eliminating outdated accounting and finance systems, and embracing UHNW portfolio management technology. Data aggregation and validation in and of itself can be extremely cumbersome and time consuming when data is received on different timelines and in different formats. An UHNW portfolio management platform allows investment teams to more easily collect and aggregate transaction data across all asset classes and improve investment data accuracy with near real-time data reconciliation and validation. Rather than relying on manual reconciliation in spreadsheets to flag data anomalies and fix data integrity issues, the right portfolio management technology will automate this process and eliminate the burden.

- Current systems aren’t equipped to handle all asset classes. UHNW investors are no strangers to receiving ad hoc investment data in a variety of formats. Each asset class and manager has its own way of delivering performance reports, resulting in a nightmare for you and your team. An UHNW portfolio management technology platform is designed to accommodate all asset classes – including private equity, hedge funds, real assets, real estate and more. The right technology platform will also offer a flexible reporting interface that allows for personalized classifications at the holding, account, entity and portfolio levels, without duplicating holdings or transaction recordings on the back-end. Rather than spanning multiple spreadsheets and systems to view an entire multi-asset class portfolio, you get a single view of the entire investment portfolio – which allows teams to make smarter investment decisions based on the most accurate data available.

- Constantly identifying inaccuracies in portfolio reports. Tech-savvy UHNW investors have grown tired of manually collecting, aggregating and validating investment data, only to then identify inaccuracies in the investment portfolio once reports are generated. Especially when those reports take two-to-three weeks to produce. Spending that amount of time generating reports only to discover that calculations are off by 10-30 points is enough to make anyone demand better technology. Discrepancies in reconciliation and reporting leave investment teams frustrated and overwhelmed. Rather than continuing with the status quo, tech-savvy investors, family offices and private banks are adopting UHNW portfolio management technology and optimizing portfolio management processes to dramatically improve efficiency, accuracy, visibility and agility.

Ultimately, tech-savvy UHNW investors, family offices and private banks want to ensure they’re making the right decisions with the information at hand. Issues with outdated technology and processes can prevent teams from spending time on investment analysis, portfolio evolution and growth.

Once the right UHNW portfolio management technology platform is in place, the system will automate much of effort inherent in data aggregation, reconciliation and validation – eliminating frustration and freeing up time. In turn, you get to spend more time on strategic investment decisions. With technology uniquely designed for UHNW portfolio management in place as the backbone of your multi-asset class portfolio management process, you get more accurate data and are able to more quickly create reports and easily model new investment strategies – all on a single platform.

Don’t settle for outdated technology designed for the masses. Discover how Private Wealth Systems is uniquely designed for UHNW portfolio management and can deliver the holistic view of your investment world you need. Contact us to learn more.