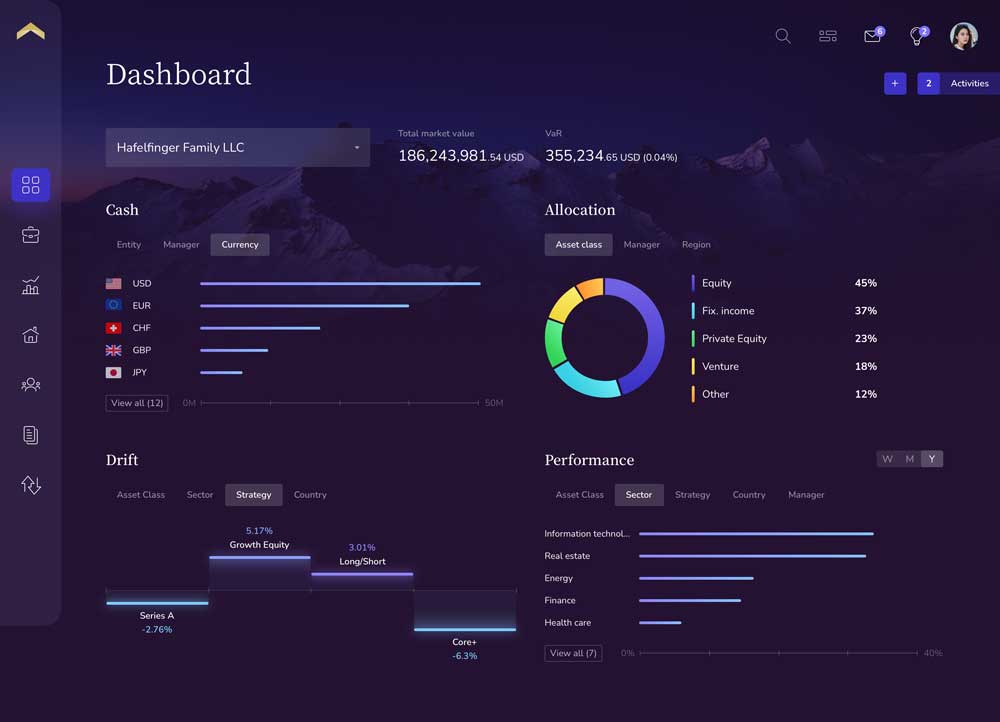

The nature of private investments – like hedge funds, private equity, real estate, real assets and other alternatives – makes managing ultra-high net worth (UHNW) portfolios complex. Aggregating public data from multiple custodians and banks can be just as complicated.

Over the years, UHNW individuals, family offices and private banks have cobbled together custodial data, accounting systems, asset-specific technologies and spreadsheets to manage these investments. However, investment and operations teams have found that these technologies were built to handle different needs, and thus lack the native infrastructure needed to achieve a holistic and accurate view of a multi-asset class portfolio.

Change is needed but finding technology that meets the modern needs of UHNW portfolio management can be overwhelming.

There are many technology vendors in the marketplace claiming to handle multi-asset class portfolio management. Institutional systems have been used to handle portfolio management for years, but they are often expensive, difficult to use and require dedicated professional services. Homegrown solutions and spreadsheets can quickly become time-consuming, human-intensive, difficult to maintain and prone to error. Fintech vendors claim they can reconcile alternative asset data and normalize information across reporting formats – but in reality, many fail to live up to the level of accuracy needed for UHNW portfolios.

Private Wealth Systems recognized these challenges and built a technology platform uniquely designed for UHNW portfolio management. To help you cut through the market noise, we have created a simple chart showing a side-by-side comparison of Private Wealth Systems versus other vendors.

Download your copy and contact us today to learn how you can transform your approach to UHNW portfolio management and enable more informed investment decisions.