Imagine having investment data you can trust, delivered fast enough to still be relevant for informing investment decisions. This seemingly straightforward scenario is often unattainable for individuals and family offices managing complex ultra-high net worth (UHNW) portfolios.

UHNW portfolios are complex because in addition to stocks, bonds and other public assets that offer real-time access to performance reports, UHNW portfolios also contain private investments – e.g., private equity, real estate, art and collectibles – each of which reports on investment data in varying timelines and reporting formats. Normalizing information across varying timelines and formats is time consuming and difficult. Now factor in the need to tailor reports to each individual stakeholder and the complexity skyrockets.

Anyone responsible for managing a UHNW investment portfolio knows that aggregating and validating data is huge drain on resources and a big source of frustration. The logical solution is to invest in portfolio reporting technology. But most accounting and fintech solutions were not designed for UHNW portfolio management. Legacy solutions do not handle private assets well, and private-asset focused solution are typically siloed and designed for one asset type. As a result, UHNW investors are still relying on spreadsheets to aggregate, validate and report on investment data.

Selecting UHNW portfolio management technology that works.

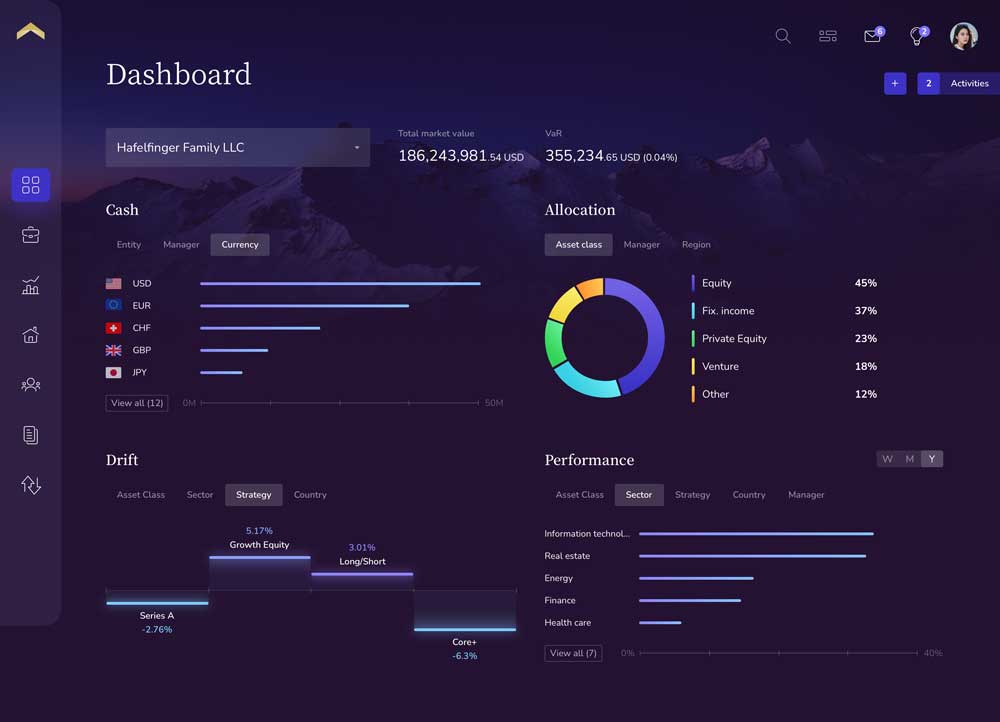

Relying on manual reconciliation and spreadsheets to manage an UHNW portfolio is often described as an operational nightmare. Luckily, there is a technology solution that is uniquely designed for UHNW portfolio management. Having a system that allows you to simply click and populate investment information you need for your stakeholder can be your reality. The Private Wealth Systems UHNW portfolio management platform was built for UHNW wealth owners and family offices. The platform innately handles both public and private assets and sets a new, better standard for performance data accuracy. The technology framework centers around 4 Pillars of Portfolio Management – Aggregate, Validate, Report and Evolve – which allow you transform how you aggregate investment data, validate data accuracy, report on multi-asset class portfolio performance and evolve complex investment portfolios over time.

Our approach enables you to easily collect, aggregate and normalize investment data and ensure its accuracy with near real-time data reconciliation and validation. We take out the manual manipulation of data and provide investment information you can trust in a fraction of the time your team would spend in spreadsheets. With the correct information feeding into interactive dashboards, your team can quickly generate wealth reports for wealth owners and stakeholders on demand.

Without the operational headache of data aggregate, reconciliation and validation, you gain more time to focus on investment analysis, portfolio evolution and growth – all with the peace of mind that Private Wealth Systems can handle the complexity and scalability requirements of your current and future portfolio.

Solving the UHNW portfolio management dilemma is doable with the right technology in place. Contact Private Wealth Systems to learn more about our UHNW portfolio management technology platform – uniquely built for UHNW individuals, family offices and private banks.