Q. We’d love to hear more about Private Wealth Systems and your role as co-founder and CEO?

Private Wealth Systems is a global financial technology company that is focused on transforming how high net worth investors, and their trusted advisors, engage in the management of their wealth. High net worth investors control over $56 trillion in global private wealth, yet they lack the basic ability to have a single consolidated view of their total wealth – limiting their ability to make informed financial decisions. The best example of this is Brexit where investors lost over $2 trillion in a single day. I still hear from family offices around the world who didn’t understand their exposure to Brexit until they received their month-end or quarterly statements from their manager indicating a substantial loss. Wealth is fragile and it can’t be managed blindly.

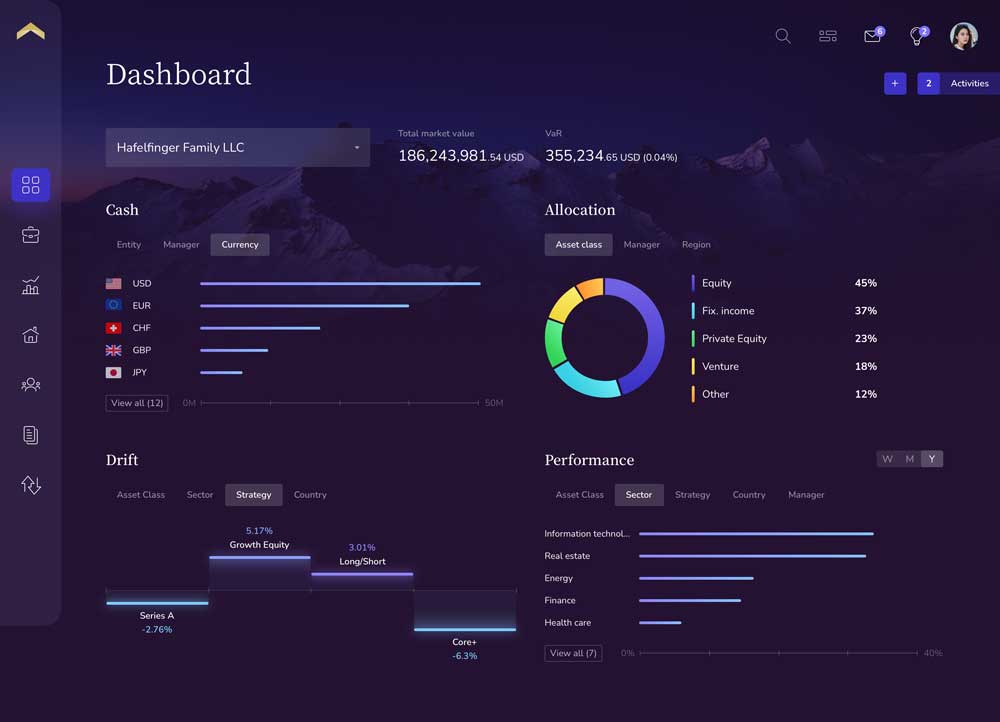

By blending decades of unique domain expertise with modern digital technologies Private Wealth Systems is the only digital platform that provides global high net worth and ultra-high net worth investors with consolidated, summary-to-transaction level transparency across their total wealth; capturing, consolidating, cleansing, calculating, and presenting actionable and personalized insight across every account, asset class, custodian, currency, and complex entity structure to drive informed and empowered decision making. From public securities like equities, fixed income, and currencies to private equity, real estate, hedge funds, operating businesses, and venture investments as well as art and collectibles – we provide a single platform so those who manage complex wealth can make better decisions faster with confidence and control.

For individuals with sophisticated wealth our proprietary platform serves as a mobile personal financial management (PFM) application that empowers individuals with the information they need to engage and gain active oversight over the preservation and growth of their private wealth. For wealth managers and advisors our cloud-based consolidated investment reporting platform reduces the operational burden and regulatory costs of omni-channel client reporting while providing a total 360-degree view of their clients’ global portfolios that elevates and differentiates the symbiotic investor-advisor relationship.

You can think of us as a technology platform that provides the personalized precision of a family office solution with the scalability and security of a global enterprise banking platform. My co-founder and I started the company in January 2015, we launched our first release in Q1 2016, and over the past few months we have attracted over $3 billion in individual high net worth assets across 3 continents.

As CEO and Co-Founder of the company I am focused on fulfilling the industry’s promise of a software platform that democratizes the data stored across disparate silo legacy systems in order to provide true transparency and actionable insight across a complex investor’s total wealth. We are committed to providing information that is tax-level accurate, comprehensive enough to support every financial instrument and investment vehicle, timely enough to be relevant and actionable, and personalized to reflect the unique sophisticated views of each individual. ….and in my spare time I remain focused on helping reshape how financial services will be delivered and managed in the decades ahead.

Q. What motivated you to launch Private Wealth Systems?

The core motivation is deeply personal. My father inherited multi-generational wealth, and like many third-generation family members, he never engaged in the management of his wealth. He entrusted his wealth, blindly, to his advisors. Like many advisors my father’s bankers took concentrated risk chasing the hope of generating excess returns. Sadly, without having a tool to provide centralized oversight my father and his bankers did not understand the extent of the collective risk and ultimately his wealth was lost. I am a living example of the proverb shirtsleeves-to-shirtsleeves in three generations. My father is a proud man from a strong successful family, but his failing was a lack of engagement in his wealth. I don’t want anyone to experience what I experienced as a teenager. I built this platform for people like my father, his advisors, and candidly even for younger generations to engage in the conversation around their family’s wealth.

The secondary motivation is based on my experience and position in this industry. Prior to co-founding Private Wealth Systems, I ran and eventually sold what was at the time the largest consolidated wealth reporting company. When I became president of that company I looked at acquiring competing platforms across the Americas and EMEA. However, the more I analyzed competing systems the more I realized that they were all reliant upon legacy technology platforms which suffered from a lack of scalability and extensibility. I knew that in order to truly transform the private wealth industry I needed to build a new, modern platform from the ground up. So I sold that company and 30 days later Private Wealth Systems was started. I co-founded the company with Joanne Frawley who has over 20 years of experience in this industry, and she has helped design and build platforms for the Rockefeller family, several leading legacy vendors, and a top global private bank. As a new company, we have the unique opportunity to build a truly revolutionary platform that is built based on dominant domain expertise with the advantage of modern digital technologies.

Q. Recently Voted ‘Best Wealth Management Technology Platform’, Private Wealth Systems is seen as a Gamechanger in the market. What defines a Gamechanger in your eyes?

From my perspective a Gamechanger is a sustainable innovator – an individual, company and/or technology that fundamentally transforms the industry by challenging current orthodoxy or frameworks and reimagining how to solve the “problem” or even recasting the problem itself. One of my favorite quotes is from Henry Ford who said, ‘if I asked people what they wanted they would have said a faster horse’. Reimagining the problem helps to create a game-changing solution.

At Private Wealth Systems, our aim is not just to offer the single best investment reporting platform, but to design truly transformative technologies and tools that will reshape the dynamics of the market and change how financial services are delivered, consumed, and managed. One of the top global private banks recently said that Private Wealth Systems is in the best position to become the Amazon.com of financial services to the global high net worth community. What we are building is much more than just a consolidated wealth reporting platform.

Q. What are the 5 key attributes to fit the “Gamechanger” title?

A Gamechanger is about more than just a great, innovative idea. It is also about an attitude and an ethos that permeates every dimension of the company – its strategy, its leadership, its culture, and its people. These are the factors that turn a compelling concept into concrete reality. While I believe there are many attributes that can be associated with Gamechangers, from my perspective the most essential are: originality, passion, audacity, focus, and tenacity.

- Originality. Great leaders and great companies are never copycats. Instead of copying they create, challenging the status quo with fresh ideas and finding innovative ways to transform how business is done.

- Passion. The best companies and products require passionate ‘believers’ that are able to generate enthusiasm internally and externally. The experience my family had losing their wealth gave me incredible passion to overcome all challenges associated with starting a new company and making a lasting impact.

- Audacity. Originality and passion alone are not sufficient – Gamechangers need bold, audacious leaders willing to take exceptional personal and strategic risks to translate the concept into reality.

- Focus. Activity alone does not result in progress. The ability to clearly define and relentlessly maintain focus despite inevitable “noise” and potential distractions is critical to successful execution on every front – from product design to company strategy.

- Tenacity. Amelia Earhart once said, “The most difficult thing is the decision to act, the rest is merely tenacity.” Companies that seek to change the game inevitably do so in the face of considerable resistance, doubt and even setbacks. The successful ones are led and built by persistent, tenacious individuals who refuse to give up or back down regardless of the obstacle.

Q. As an industry-defining financial technology (FinTech) company, can you shed a little light on the philosophies of your company and how you’re making such an impact in the industry?

Our philosophy is that the individual wealth owner, and their trusted advisors, should have total transparency regardless of financial complexity. A twenty year old with ten thousand in savings has plenty of FinTech tools available to gain oversight over their money. Yet someone with $10 million to $10 billion has literally no means of actionable oversight over their wealth – it’s crazy. High net worth investors should have the information they want, when they want, in the format they want, on the device they want, in order to be an active participant in managing their wealth. Where the majority of other software platforms focus on the institution, Private Wealth Systems focuses on the high net worth individual who remains unserved by other systems because of their level of financial complexity. By providing digital, personalized, one touch access to all of the financial information within a complex global portfolio, we believe we can fundamentally shift greater control back into the hands of the high net worth individual enabling them to have a better understanding of their wealth and how it’s managed. In turn, access to this level of data will also give advisors the ability to provide better guidance to their clients, further cementing the investor-advisor relationship.

Q. What are the key elements to achieving this?

I think the most important element to achieving our objective is clarity of purpose. Because of my personal experience, as well as my experience in this industry, I have had a very clear, precise vision of the ‘problem’ I was seeking to solve and the market/client I was seeking to serve. In turn, I have worked with my entire team to ensure that there is complete alignment around this vision. In order to realize our objectives and build a lasting organization the vision cannot be mine alone – it must be understood, shared, and embraced by everyone across our entire company. The other key element is building the best team possible. My team is incredibly talented with unique and diverse domain expertise from across this industry. We have the experience to know what has worked and what has caused other systems to fail, and we are building our platform fully from the ground up based on lessons learned, collectively, across two decades of serving the most complex but vital segment of the financial market.

Q. What are the most common risks involved at Private Wealth Systems and what is implemented to reduce these?

The risk is the same for any young, fast growing company; vision and execution. It’s easy to get distracted and chase new opportunities that unexpectedly present themselves or react to timeline pressures or resource constraints. But the difference between success and failure is based on our ability to maintain focus on the vision and steadfast dedication to daily execution. I am very grateful to have the industry’s best team because we have been able to design, develop, and deploy arguably the most sophisticated and powerful platform in the world within eighteen months from inception. I am constantly being told by clients that Private Wealth Systems has done more in less time with less resources than any other company in this industry. That is real validation and it’s a testament to our belief in vision and dedication to execution.

Q. Providing a total wealth dashboard, what are you doing that other private wealth advisors aren’t?

It’s important to note that we are not an advisor. We don’t provide advice or take possession of any assets. Our software platform is completely unbiased and independent of any manager, advisor or custodian. Individuals need an independent view to analyze and judge manager performance. Now if you asked what we are doing that other FinTech platforms aren’t I would say ‘Everything’ including market segment, platform capabilities, and strategic vision. Unlike the vast majority of FinTech platforms which are focused on the mass affluent, we are focused on the high net worth and ultra-high net worth segments on a global scale. The level of financial complexity within this market is so high it has created organic barriers to entry. These barriers have prevented HNWI/UHNWI from enjoying the benefits of financial empowerment from today’s modern digital financial applications. In order to succeed in this market you need a platform that was born from this market, and you need a team that possesses demonstrable and dominant domain expertise in capturing, consolidating, cleansing, calculating, and presenting multi-asset, multi-custodial, multi-currency investment data that is purposely designed to be consumed by the individual high net worth investor, and not just their advisors. Our experience and expertise has enabled us to develop a unique data architecture that no other system has been able to replicate and offer a platform that has capabilities far greater than any legacy platform or service provider. Our proprietary technology can take the most complex financial

portfolios in the world and transform the data into simple, clear, and highly personalized actionable insight. Other points of differentiation include;

- Comprehensiveness: Our platform supports every asset type – from standard marketable securities to structured products, alternative assets including private equity, hedge funds, real estate, direct investments, as well as physical assets such as art and collectibles. We also support ownership complexity from partnerships and pooled investment vehicles to nested structures.

- Design: We continue to invest heavily in designing customized, interactive graphics that enable highly complex calculations to be displayed in the most engaging and intuitive manner. Being purposeful with the use of color, white space, and relevant iconography as a language to help drive understanding, we are able to depict the drivers of risk and return across complex global portfolios in a simplified yet sophisticated manner.

- Extreme personalization: Our platform empowers individuals to classify their data based on their own unique perspectives, and view the information they want, when they want, in the format they want, on the device they want. Is Amazon a retail company or technology company? Is Apple socially responsible? Is Bridgewater’s All Weather Fund a US fixed income fund? The answer is unique to each individual, and impacts asset allocation, planning, and how an individual’s wealth is managed. Our platform is the only platform that enables a personalized security master on a mass scale.

- Dual Support Model: Private Wealth Systems offers a dual support model that allows a client to either manage the platform and data entirely on their own or fully-outsource all aspects of the data management to Private Wealth Systems’ data management team.

- Global extensibility: Our system natively supports all aspects of multi-currency and multi-jurisdictional wealth. Not only can we accurately track the local, base account and reporting currency, but we can show the impact of currency movements on performance.

Q. Will you share some success stories with us?

From a company standpoint we are very proud of designing, developing, and deploying what many are calling the most powerful consolidated wealth reporting platform on the market in under 18 months from inception. We are also excited to have successfully undergone the due diligence process of our lead investor, who ran the technology investment group for one of the world’s largest private equity firms and is arguably one of the most astute and experienced technology investors. We are equally excited by the material impact our platform is already having in helping clients organize and understand what and who is driving their risk and return across very complex global portfolios. Most recently, we had the CIO of a family office tell us that our platform has helped the family begin to communicate and engage one another about the family’s wealth, across several generations, in a way they haven’t done before due to the limitations of their previous system. Separately, we had a rapidly-growing wealth management firm tells us that our platform will enable them to scale more effectively because of the significant operational and regulatory efficiencies gained from not having to use Excel for manual reporting.

Q. How will we see Private Wealth Systems develop over the course of the year?

2016 is our second year of operation and from a development perspective our focus is on continuing to aggressively build out a broad range of new features and functionality within four core areas.

First, we remain committed to empowering individuals and their advisors to manage and control their data themselves. Although we are unique in our ability to offer a dual-service model and can provide HNWI/UHNWIs, family offices and institutions a fully-outsourced option, we are seeing a growing trend for individuals to enter and manage their own data. To that end, we are launching our self-administration module later this summer which will provide users the ability to fully control every aspect of the platform themselves – from adding new securities and creating new accounts or entity/ownership structures through to customizing data models and classification schemas, and designing customized reports on demand.

The second major area of development this year is around the enrichment of our report library. While clients want the ability to personalize reports, they also want to be able to quickly generate standard depictions of data without having to design a new report each time. Therefore, we are adding report templates for asset allocation, target and ranges with investment policy drift, performance, holdings, balance sheet, alternative assets, and a consolidated dashboard report. With these reports users can analyze exposure and returns at the security, account and entity level, industry or sector level, manager and country level, asset class, and across custom groups, as well as view their direct and indirect exposures to a given security, asset class or country by looking through their partnership structures and pooled investment vehicles.

Expanding our analytics capabilities is the third area of focus, with interactive on screen drill downs and report-based views to enable users to quickly understand the drivers of risk and return. These capabilities include a range of standard risk metrics and performance analytics, as well several instrument and market-specific analytics such as currency contribution to return.

Finally, we are investing heavily in the development of data integrations with custodians as well as other systems. The ability to get high quality data into the platform is integral to the value of our platform. As a result, we are aggressively investing in building out our direct data connections to financial institutions as well as other premier, third-party data providers. We also believe that the ability to work seamlessly with other systems and software is essential and we built our system to interoperate with other platforms from financial planning and compliance systems to CRM and general ledger platforms.

Q. What have been some of the memorable and more challenging events since launching?

There have certainly been many memorable moments since launching our company, but the day our first client went ‘live’ on our platform certainly stands out as the most memorable single moment to date. Taking a broad vision, turning it into a defined plan, and then bringing that plan to successful fruition has to be one of the most incredibly satisfying events for any new business. After working so hard and sacrificing so much it is so exciting for our design and development team to have that initial concept become a tangible reality through dedication and teamwork.

Businesses of all sizes experience so many challenges, but I think one of the most difficult challenge to navigate for any company is building the right team. As a startup it is incredibly hard to find exceptional talent. Keep in mind the first few hires will have a profound and lasting impact on the development of the firm itself: its product as well as its identity and culture. We have been very fortunate to have assembled at the very start what one client called the reporting industry’s “dream team”. But as the growth of the firm accelerates, it is my responsibility to ensure that we continue to expand the team by adding the right individuals from an experience, expertise and cultural fit perspective. We need diverse views and brilliant minds coming together as a team to solve a problem that plagues such an vital market segment.

Q. What is key to a successful FinTech platform?

There are several key characteristics essential to building a successful FinTech platform: 1) domain expertise, 2) scalability, 3) extensibility, 4) flexibility, 5) accessibility, and 6) security. First in order to solve a problem you need to understand the root causes of the problem, and this takes decades of direct industry experience to know what works and what doesn’t. Domain expertise also drives capital efficiency which provides the highest returns on invested capital. Second, ensuring the ability to support growth requires that the technology be designed to quickly scale to support new users and data as required. As the financial services industry continues to rapidly evolve, it is also essential that the platform is extensible, enabling new features and functionality to be integrated efficiently to meet ever-changing requirements. Particularly within the high wealth segment, flexibility is also a critical attribute as clients demand highly-personalized views of their data. Furthermore, the long-term trend toward mobile engagement also means that the platforms must support on-demand data accessibility from any device. And finally, given both the nature of the information on the platform, and the profile of the clients, the platform must support and adhere to the collective security protocols of the top private banks.

Q. Who do you see as your direct competitors within FinTech, and what do you implement to stay one step ahead?

Our single biggest competitor in the private wealth space is Excel. While inherently inefficient and error-prone, spreadsheets afford investors and their advisors the flexibility to intuitively personalize their information in a way that legacy technology platforms – and even newer ones – simply cannot. This is why we built our platform to provide clients the near limitless flexibility and customization capabilities of Excel, but on a secure, scalable, and compliant technology foundation.

Beyond Excel, there are a few niche providers in the industry that remain challenged by their own legacy platforms. The cost and time for legacy platforms to upgrade and respond to modern demands remains prohibitive which is why we are seeing consolidation among the older technology providers. By contrast, there are also newer Silicon Valley start-ups that have spent tens of millions of dollars attempting, but failing, to succeed in this industry because they lack the underlying domain expertise to truly understand the requirements of the market, and they have proven not to be a lasting competitor.

It is my core belief that you need to come from this industry in order to succeed in this industry. Understanding the nuances of capturing, consolidating, cleansing, calculating and presenting multi-asset, multi-currency, multi-custodial investment data is not just a technical challenge – it requires deep, direct experience and understanding of best practices. While we have built the most technically-advanced platform on the market, it is our collective decades of domain expertise that has created a revolutionary solution that will transform the private wealth industry. Keeping ahead of the competition over time will require that we continue to invest heavily not only in our technology but in attracting the best and brightest subject matter experts from around the world.

Q. Which markets have seen huge growth and development over the past 12 months, and which are showing potential for the coming months?

Candidly I have been surprised by the level of demand for our platform across all major markets. We had our initial launch in January 2016 and we already have over $3 billion in individual assets across three continents. We continue to see strong demand from the Americas as well as Northern Europe, and Switzerland in particular. As individual wealth becomes more complex and market volatility increases, the demand for faster, more comprehensive, and personalized actionable information will grow exponentially. We are the perfect hedge against market volatility because the more challenging the economic environment the more demanding and emotional HNWI/UHNWI become about understanding, accessing, preserving, and growing their wealth.

We are starting to see increasing interest from Asia-Pacific as well as larger institutions who need to provide a better solution to their advisors and clients.

Q. It has been reported that large unbanked populations in countries such as India and the emergence of tech-savvy middle classes in countries such as China, Indonesia and the Philippines, will offer significant growth opportunities for financial technology (FinTech) companies. What is your opinion on their role within Asia-Pacific’s financial services industry?

In 2014, for the first time ever, the number of high net worth investors in Asia-Pac outnumbered those in the United States, with 4.69 million individuals controlling $15.8 trillion in private wealth. The explosive growth in wealth and the number of wealth owners across the region has created enormous opportunities for FinTech and FinServ companies to meet this demand for omni-channel access to financial services. The lack of existing infrastructure allows a fresh start in re-imaging how these wealth owners can be supported, and done so on their terms eliminating the information and transaction friction that exists with legacy infrastructures – it’s incredibly exciting.

Q. It is believed that the barriers to entry for FinTech platform firms are greatest where banking markets are more concentrated. Do you agree that for emerging markets, financial systems with fragmented banking systems that have seen limited innovation will be the most exposed?

I would argue concentrated banking markets do not increase the barriers to entry but rather increases the barriers to longevity. Concentrated banking markets are burdened with regulatory restrictions that prevent large FinServ companies from innovating and quickly responding to ever-changing client demands. These restrictions create enormous opportunities for financial technology companies to create new technologies that reduce or eliminate the cost and friction associated with concentrated banking markets. Just look at the remarkable success of the digital/robo-advice market or peer to peer lending. Their successes were achieved in the most concentrated banking markets in the world. Yet the barriers to entry for robo, P2P, and other point solutions is near zero. This is why the challenge these platforms now face is one of longevity as the largest FinServ companies enter their market, eliminating platform differentiation while leveraging their enormous distribution, brand, and pricing power to dominate those market segments. In markets with low barriers to entry FinServ will force FinTech platform to consolidate or close.

Longevity in concentrated markets requires true sustainable differentiation and high barriers to entry that prevent even large FinServ companies from entering the market. In our industry HNWI/UHNWI demand an independent platform that is completely agnostic to any custodian, advisor or financial services provider. Several large global banks spent $75 million to $125 million trying to build and offer a consolidated reporting platform like Private Wealth Systems. But the large banks realized the barrier to entry included the requirement of independence and objective analysis, and the banks ultimately chose to collaborate rather than compete in our industry. Our market segment has organic barriers to entry that prevent other FinTech companies (because of lack of domain expertise) and FinServ companies (because of lack of independence) from entering our market. The higher the barrier to entry the greater the probably of long term self-sustaining success.

I do agree that emerging markets offer unique opportunities for FinTech and FinServ to collaborate and work in partnership to bring truly transformative solutions to market, for the benefit of consumers and providers alike.

Q. What does the future hold for your industry?

The future will be marked by three key drivers; 1) increasing disintermediation of advice, 2) globalization of products and services, and 3) an increase in financial complexities across investment instruments and ownership structures. According to CapGemini’s 2015 Financial Services Analysis Report 43.2% of high net worth investors under 40 years of age have relationships with 5 or more financial services firms, that compares to 14.7% of investors over 40. The same report shows HNW investors are allocating 35.8% of their wealth outside of their home countries, up from 25% two years prior. As more investors begin to work with multiple advisors, and they increase their exposure to outside countries, their level of complexity will be prolific. The need for consolidated reporting will become a necessity for high net worth individuals as well as their advisors.

Q. Where do you see Private Wealth Systems in ten years’ time?

Because our platform captures every financial transaction a high net worth individual makes across their entire financial life – across both assets and liabilitis, and since we are completely agnostic to product, advisor, and custodian, we will become the foundational infrastructure to a single integrated frictionless digital ecosystem that will be at the center of every financial interaction between financial consumers and financial services/product providers.

Imagine the year is 2026 and Byrnes Hafelfinger, a US-based high net worth individual, is on a business trip to Chennai. He receives a Private Wealth Systems alert on his mobile device showing that he just received a $1.2 million distribution from Carlyle. Leveraging predictive analytics that reviews Byrnes’ profile and portfolio, our platform will instantly offer several points of action Byrnes can take to reinvest or spend his funds. He will be alerted to the fact that he is below his target allocation for high yield fixed income in Brazil, below his target for socially responsible investing in healthcare, and under exposed to global real estate. Based on his subscription preferences, which allows financial services providers to send product information based on Byrnes’ specific requests, he can view the list of products that meet his criteria. From his device Byrnes calls his trusted advisors at UBS in Switzerland and JP Morgan in the U.S., which he has entitled to see all of his investments. Following the advice of his advisors Byrnes decides to invest 855,387 Brazilian Real in a local high yield product offered by J Safra Sarasin, invest 16,741,237 Indian Rupee in a special purpose investment vehicle, created by Citi in Singapore to build private healthcare clinics throughout India’s most impoverished regions, and invest 175,370 British Pounds in Blackstone’s real estate fund through a new relationship at Morgan Stanley which provided the analysis and information on Blackstone through Private Wealth Systems. Byrnes then invests $200,000 across four start-ups he viewed in his Private Wealth Systems’ venture capital marketplace, and takes the remaining balance to purchase a new boat that he has been researching just in time for summer vacation. He then updates his Private Wealth Systems’ social peer network profile, through his avatar to ensure personal privacy, announcing that he just invested in building healthcare clinics across India, challenging others across the global HNW/UHNW community to increase their allocation to investments that make a personal impact. What would have taken days or weeks is now completed in a matter of minutes on a single platform – Private Wealth Systems. We are removing the friction of information and action.

Q. What is your best advice for aspiring entrepreneurs and businesses in the private wealth and FinTech industries?

My first piece of advice is to learn your business better than anyone else and build a team that no one else can replicate. If you have the best team you can overcome any challenge. A competitor can replicate your platform and processes but the one thing they can’t replicate is your team. Attract, retain, and motivate your industry’s ‘dream-team’, and you will be successful. Second, FinTech entrepreneurs should view large financial services companies as a friend not an enemy. Too many entrepreneurs want to romanticize the cowboy culture of a startup and create a David vs. Goliath battle blaming all of the industry’s problems on the large banks. They need to understand banks have been around for hundreds of years for a reason. Banks have regulated restrictions that prevent them from innovating and quickly adapting to changing client demands. This creates enormous opportunities for new companies to create new solutions. But sustainable success is predicated on collaborating with the large global banks and creating a solution that works for all participants; consumers and providers.

More about the man behind the brand…

Q. What motivates you?

I am motivated by my children and a deep desire to make a lasting positive impact on people’s lives. Individual wealth can have such a profound impact on improving our world. Whether you want to fund a school in Ghana, build a health clinic in Guizhou or finance a new startup that will become the next Apple or Amazon, you need to engage and be an active participant in how your wealth is managed. I hope our platform can help individuals engage at an elevated level of knowledge, align their wealth with their personal values, and make an impact that they can be proud of in order to create their own unique legacy.

Q. What does success mean to you?

Success, for me, is having the ability to shape my own destiny. Whether it is spending time with family or pursuing an idea that shapes the evolution of the financial services industry, being successful is less a destination point than it is an ongoing journey. I consider myself having achieved success with each day that I am able to wake up and do what I love, surrounded by the people I love.

Q. Which three people would you most like to invite to a dinner party?

The first dinner invitation would go to George Washington. I am fascinated by the American Revolution and the relentless persistence of the Founding Fathers in the face of seemingly insurmountable circumstances. I would love to understand his mindset and the roots of his resilience during the early years of the war when he continued to fight for what he believed in despite losing every major battle. I would also like to know, in the wake of winning the war, how he so effectively transitioned from wartime military commander to nation-builder.

Second, it would be extraordinary to share a table with Leonardo da Vinci given the expansiveness of his profound genius across so many areas of thought and creativity. Perhaps the ultimate game changer, da Vinci’s explorations and contributions across art and science fundamentally transformed the trajectory of modern civilization and continues to have a lasting impact on our society today. Regardless of the topic discussed, watching his mind at work would be awe-inspiring.

Finally, as someone who has always been intrigued by those who view the world through a different lens, I would invite Pablo Picasso. Picasso used his art as a communication medium that compelled the viewer to think beyond traditional frameworks. The impact of his disruptive thinking extended well beyond the art itself, shaping the trajectories of other artists as well as the politics and thinkers of his day.

Q. What is your most used phrase in both work and play?

“When the odds are one in a million. Be that one.”

Q. What animal do you take the most inspiration from?

The Tundra Wolf because it continues to evolve and survive even in the most challenging environment on Earth. In my own experience, the ability to adapt has consistently proven to be the single greatest contributor to success and long term survival. Building a strong, stable business is about continual improvement and evolution in the face of unpredictable events that invariably force you to pivot and create new paths and opportunities. No one knows what the market conditions will be in 3, 5, or 50 years from now, so building a team and organizational culture that not only embraces change but invites it, and most importantly can adapt accordingly, is a core guiding principle.

Q. Most common thought when you first wake?

New product ideas

Q. And the last before you sleep?

New product ideas

Q. What song, film or piece of literature best describes your life?

To Kill a Mockingbird had a strong impact on me. The central theme of staying true to your core values regardless of the pressure to conform to others’ ideals has been a core principle of mine throughout my life. Staying true to yourself is not always easy, but in the long run you will be happy to never have sacrificed what you believe is right.

Q. What makes you howl with laughter?

Negotiating anything with my kids. As any parent can attest, the reasoning skills of an eight-year-old are hilariously funny. Needless to say, once you begin laughing your negotiating power is effectively gone.

Q. What brings a tear to your eye?

Watching my kids grow up and become independent – tears of joy and sadness.

Q. Have you ever stolen a pen from work?

Too many times to count.