Ranking based on Private Wealth Systems’ leadership in reshaping private wealth industry

CHARLOTTE, N.C. –Private Wealth Systems, Inc., a global financial technology company that provides financial software and data management services to high net worth (HNW) and ultra-high net worth individuals (UHNWI), private banks, family offices, and RIAs, today announced it was ranked among the top twenty financial technology companies in this year’s FinTech Forward rankings, a joint initiative between American Banker and the Bank Administration Institute. The FinTech Forward program identifies the most innovative technology companies that are reshaping the future of financial services.

As one of the Top FinTech Companies to Watch, Private Wealth Systems is recognized among a group of innovative organizations that remain committed to helping the global financial services industry bridge the digital divide. The Company’s first release of its next generation consolidated wealth reporting platform earlier this year has already attracted over a dozen ultra-high net worth individuals and family offices across seven countries including; Switzerland, United Arab Emirates, Mexico, the United States, Canada, the United Kingdom, and Panama.

“We are incredibly excited to be recognized for our effort in solving the three core challenges to eliminating the information and transaction friction that exists in today’s private banking infrastructure; data capture, data processing, and data presentation,” said Craig Pearson, CEO of Private Wealth Systems. “By bringing the power of disparate legacy back-office systems and processes to the fingers tips of those who have or manage complex wealth we can transform the interactions between consumers, producers, and advisors of financial services into relationships that are more meaningful, more scalable, and more personalized.”

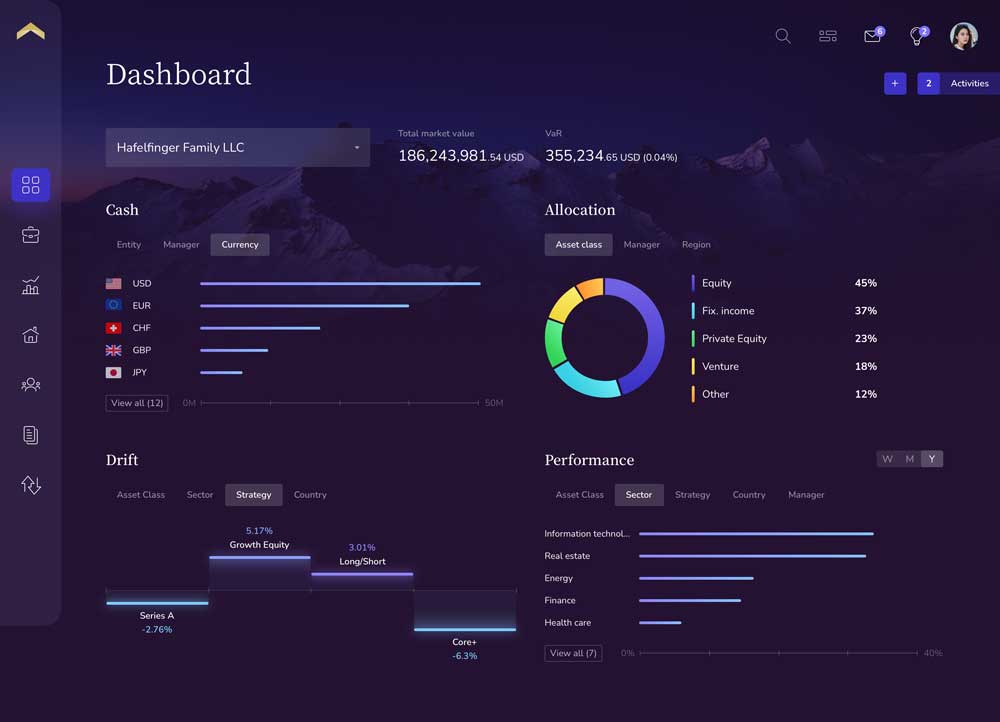

Private Wealth Systems’ subscription based software platform captures, consolidates, cleanses, calculates, and presents actionable personalized insight across every transaction, account, asset class, custodian, and currency to drive better, more informed decision making. By blending decades of domain expertise with modern digital technologies Private Wealth Systems is the only platform that provides high net worth and ultra-high net worth investors with consolidated, summary-to-transaction level transparency across even the most complex global portfolios. For individuals with complex wealth Private Wealth Systems’ proprietary platform serves as a mobile personal financial management (PFM) application that empowers individuals with the information they need to engage and gain active oversight over the preservation and growth of their personal wealth. For wealth managers, the cloud-based consolidated investment reporting platform reduces the operational burden and regulatory costs of omni-channel client reporting while providing a total 360-degree view of their clients’ global portfolios that elevates and differentiates the investor-advisor relationship. Purpose built to support ultra-high net worth individuals, the software platform supports every asset type – from standard marketable securities to structured products, alternative assets including private equity, hedge funds, real estate, direct investments, as well as physical assets such as art and collectibles.

About Private Wealth Systems, Inc. Private Wealth Systems is a global financial technology that is revolutionizing the way private wealth is analyzed, reported, and managed. The company provides a total wealth dashboard with transaction-level-transparency so investors and their advisors have instant access and understanding of the drivers of risk and return across all their investments, regardless of complexity, currency, asset class, or entity structure. A simple touch on your mobile device and you have absolute control and oversight over your entire wealth with reporting that is as personalized as you are. One Touch Total Control.

For more information about Private Wealth Systems, visit www.privatewealthsystems.com or call US +1 980 500 3000.