Sharp, unpredictable market changes and the potential of a looming recession have ultra-high net worth (UHNW) investors and advisors on their toes. Inflation is widespread, interest rates have dramatically increased and an economic recession looks imminent. This level of market volatility and economic uncertainty makes it difficult for UHNW individuals, family offices and banks accurately assess the state of their portfolio. This creates frustration among ultra-high net worth investors who need accurate asset allocation, liquidity and risk data in order to assess the impacts of an economic downturn on their short-term and long-term growth objectives.

Public investment data is always at your fingertips. But, alternative investments, like real estate, private equity, hedge funds and real assets, lack real-time access to vital investment information due to the nature of investment reporting timelines. Investors often compensate for lags in reporting times for alternate investments by using spreadsheets and manual reconciliation to cobble together a “good enough” view of their investment portfolio for quarterly investment meetings. However, when the market plummets (or spikes) significantly between portfolio reporting consolidation efforts – investors and family offices are left without a truly accurate understanding of how market volatility is impacting their wealth.

It’s time to shake up the status quo.

It’s time for wealth owners to set a new, better standard for investment accuracy. Savvy UHNW investors, family offices and private banks are turning to multi-asset class portfolio management technology to ease the burden of manual data collection and validation and enable investment teams to focus more time on investment analysis and portfolio growth. The result? They have a more accurate, holistic view of the complete portfolio so they can understand how the shifting market impacts investments over time.

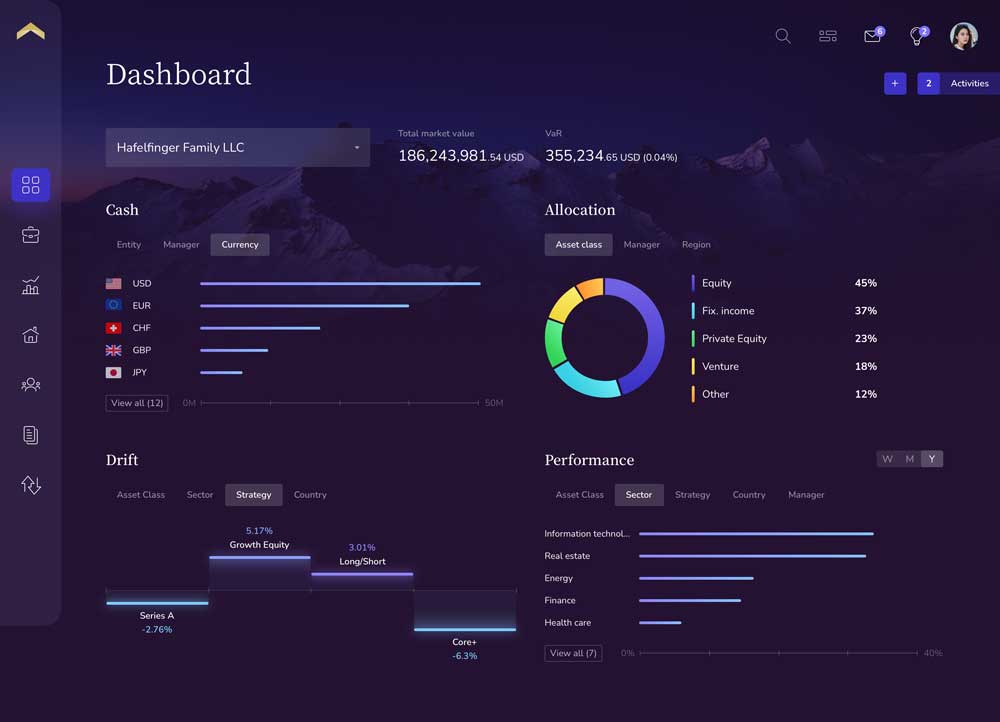

Private Wealth Solutions is leading the charge in empowering UHNW investors with better data accuracy through its multi-asset portfolio management technology platform. By focusing on four critical pillars in the investment management process – aggregate, validate, report and evolve – the Private Wealth Solutions portfolio management technology platform is helping UHNW investors, family offices and banks navigate market volatility with consolidated reporting and analysis in order to:

- Seamlessly collect, aggregate and normalize investment data. Imagine being able to efficiently collect and aggregate investment data across all asset classes. Rather than enduring hours of labor-intensive data scraping and consolidation, you can leverage portfolio management technology to automatically capture and aggregate transaction data and bank data feeds. The result is faster access to data across all asset classes.

- Improve investment data accuracy with near real-time data reconciliation and validation. Right now, your investment data is likely delivered in different formats and different timeframes. When data is manually entered and reconciled, its accuracy is called into question. With a portfolio management technology platform like Private Wealth Systems, you can flag and automatically resolve data discrepancies – removing administrative burden from you and your team.

- Gain faster portfolio insights and quickly generate reports for wealth owners and stakeholders. Unlike other portfolio management platforms, Private Wealth Systems works on trade date, accounting for only when an asset is owned. Investors benefit from a flexible reporting interface that allows for personalized classifications at the holding, account, entity and portfolio level, without duplicating holdings or transaction recordings on the back-end. You now have a single view of your portfolio across public and private assets to better manage your wealth.

- Free up more time for investment analysis, portfolio evolution and growth. Once you’ve made the move, data aggregation, reconciliation and valuation can be handled by the portfolio management technology platform. This allows you to spend more of time on investment due diligence and making strategic investment decisions. Private Wealth Systems enables easy modeling of new investment strategies that you can put in place to more effectively evolve your multi-asset class portfolio over time. With a single view of the entire multi-asset class portfolio and more accurate investment data, you gain a clearer understanding of liquidity, exposure and risk.

Market volatility is inevitable. Inefficient, inaccurate portfolio performance reporting should not be holding you back.

Are you ready to have your entire multi-asset class portfolio data at your fingertips? Contact Private Wealth Systems to learn more about our portfolio management technology platform – uniquely built for UHNW individuals, family offices and banks.