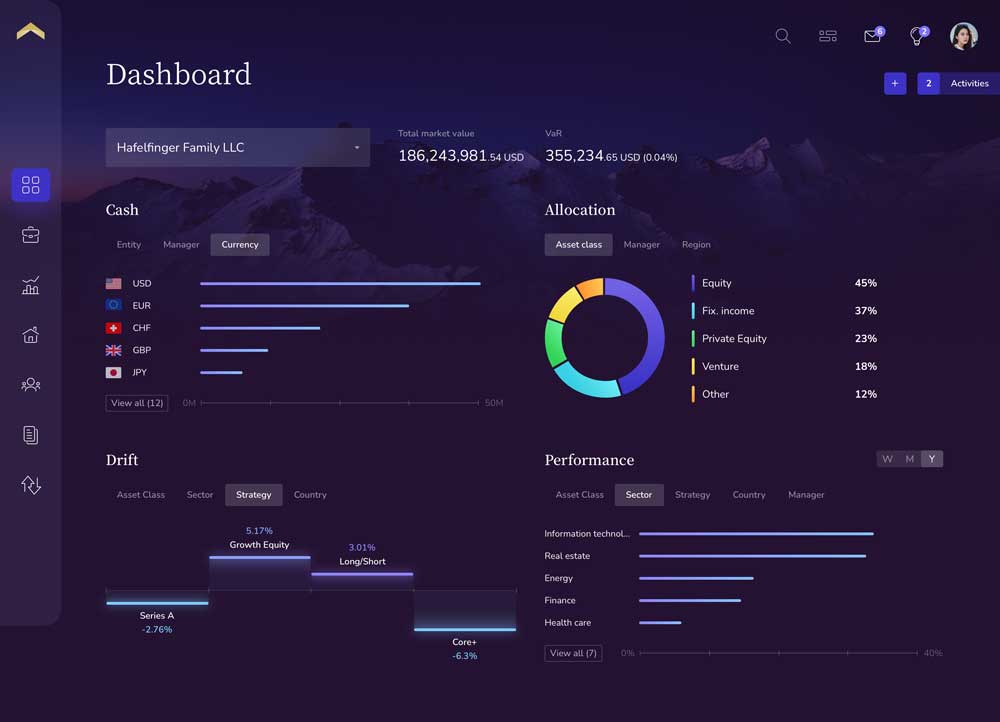

Many family offices today have access to more data than ever — yet still lack the clarity to act on it.

Traditional reports may show total wealth, asset allocation, or basic performance, but they rarely answer deeper questions:

Which managers are truly delivering value? Where are we taking on risk? Are we overpaying for underperformance?

At Private Wealth Systems (PWS), we believe wealth should be managed with the same discipline and transparency as a business. That means evaluating manager performance with rigor, understanding risk-adjusted returns, and having confidence that your capital is working as intended.

From Data to Decisions

PWS is purpose-built for ultra-high net worth wealth owners — providing the tools to:

- Benchmark each manager’s performance, considering fees and risk

- Identify true contributors, not just market followers

- Support informed decision-making with reporting designed for clarity and action

The insights we deliver ultimately enable meaningful conversations and confident allocation decisions.

Elevating the Conversation

Better inputs lead to better oversight. When family offices and ultra-high-net-worth wealth owners can clearly see which strategies are creating value — and which are not — they’re positioned to ask sharper questions, engage more productively, and steward capital more effectively.

Purpose Built for the Wealth Owner

PWS brings institutional-grade tools to the ultra-high-net-worth wealth owner. With transaction-level data, daily time-weighted returns and IRR, risk analytics, and benchmarking, we make it easier to understand what’s working, what isn’t, and why.

If you’re ready to move beyond surface-level snapshots and gain a clearer picture of how your managers and strategies are truly performing, we’d love to show you how.