When my father passed away in January his total estate was valued at under $3,500. This is a man who inherited multi-generational wealth that survived through a great depression and a world war. The root cause of the destruction of my father’s wealth was friction of information. My father never had a platform that allowed him or his advisors to understand his total exposure to any given investment, theme, manager, sector or asset class.

When isolated and viewed independently, investment strategies he approved appeared aligned with his goals. However, if he had a total consolidated view across his entire wealth the concentrated risk would have been identified and corrected. Sadly, without such a platform my father’s wealth was destroyed, and with it the breakup of a once-close family.

As a teenager I lived through the implications that come with the loss of wealth. This is why today, many decades later, I remain committed in purpose and pursuit to solve the structural challenges that allow for the destruction of family wealth.

Founding Private Wealth Systems

Private Wealth Systems was founded with the commitment of empowering ultra-high net worth wealth owners and their trusted advisors with the information they need to gain actionable oversight and control over the management of their wealth regardless of size, complexity or global jurisdiction.

This is why we have taken the time and made the capital investment to build a system that is structurally different than any other accounting or reporting system. Recently a senior executive in operations at a global private bank said we have created the first meaningful innovation in the private wealth industry in the past 40 years – we are creating a new paradigm in global finance by shifting the power of information and action from the heavily concentrated pool of financial services companies back into the hands of the millions of wealth owners, eliminating the destructive nature of friction caused by silo-based information and ill-informed action.

The Inflection Point in Global Finance

Many ask if we are disintermediating the financial intermediaries. My premise is that global finance is at an inflection point and that traditional banking and investment management organizations of the future will be comprised of ultra-high net worth individuals and consortiums of wealth owners, and not the banking and investment houses we think of today.

We already have ultra-high net worth individuals and family office clients who act as both consumer and service provider, a trend that no doubt will grow stronger during these unprecedented times. Wealth owners need to have control as to who they lend money to, borrow from, invest in, with the freedom to create new forms of financial products that will transform how financial services are created, delivered and managed.

A Glimpse into the Future

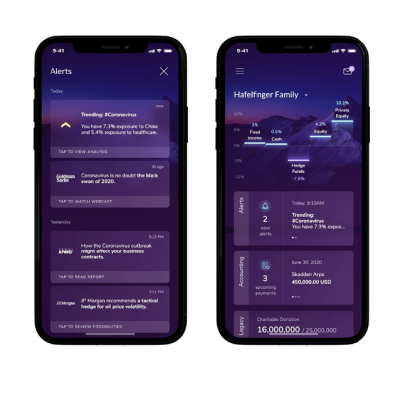

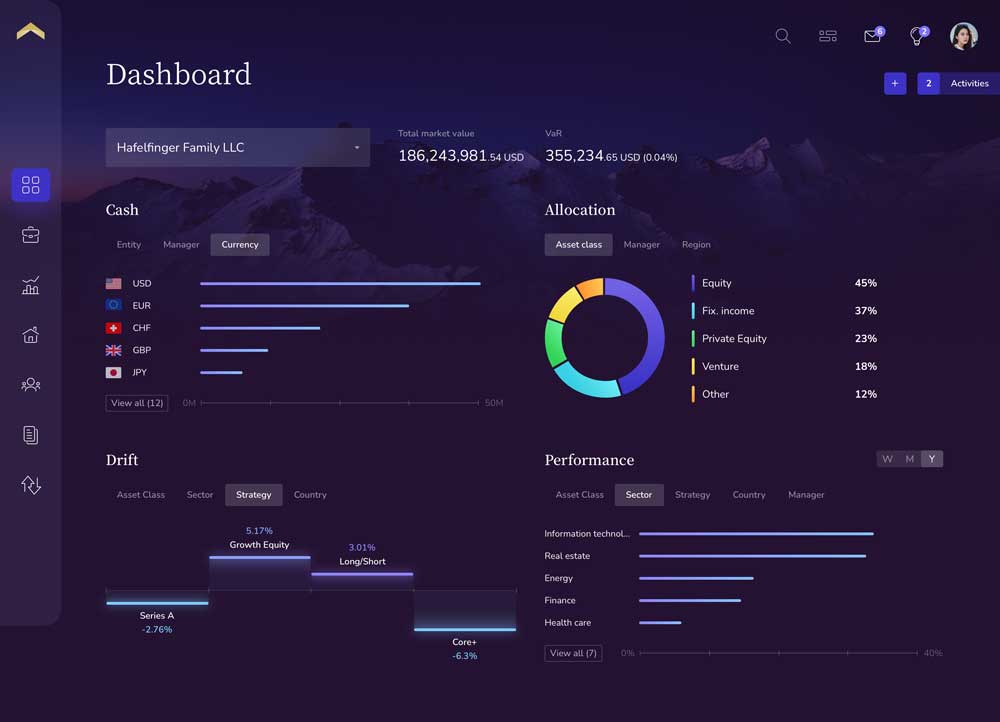

I can imagine a time in the not-so-distant future when my son, on his way to a business presentation in Chennai, receives a mobile alert notifying him of a $1.2 million distribution from his investment in a Hong Kong real estate fund he made with a family office in China that created their wealth in real estate. What would have taken weeks to research and transact is now completed in a matter of seconds on a single platform – Private Wealth Systems.

Using our application’s cognition, he will be presented with several points of action to reinvest or spend those funds. He will be alerted that he is below his target allocation for high-yield loans in Brazil to help fund emerging companies across South America, below his target for socially responsible investing in healthcare clinics in India – not as a means for charity, but for-profit businesses that are improving the safety and health across the most impoverished regions of the country – and underexposed to leveraged buyouts in the United Kingdom to drive consolidation and efficiencies across the United Kingdom’s middle market business segment.

Based on his preferences, which allows other family offices and financial sponsors to provide investment information based on his specific criteria, he can view the list of products that meet his needs. He might then decide to invest 855,387 Brazilian Real in bank loans with a family office in Brazil, invest 16,741,237 Indian Rupee in a special purpose investment vehicle created by a family office in India, and invest 175,370 Sterling in a buyout fund through a new family office he was introduced to by his advisers at Goldman Sachs and JP Morgan. He also might invest $200,000 across four fintech start-ups he viewed in his Private Wealth Systems’ venture capital marketplace that he evaluated because of his expertise in early-stage financial technology. He uses the remaining balance to purchase a new boat that he has been researching just in time for a summer vacation.

Our system is designed to improve upon the accuracy and comprehensiveness of a multi-asset, multi-bank, multi-currency accounting system, the interactivity of a portfolio management system, and the flexibility, engagement and personalization of a reporting system – capturing, correcting, calculating and presenting every component of every transaction across every financial and nonfinancial instrument in any currency regardless of ownership structure, and delivering true intelligence to those who are best able to control their financial destiny, and do so with unmatched efficiency, speed, accuracy, and personal privacy.

The Root Cause of Destruction

For context, my father is part of a multi-generational ultra-high net worth family that made substantial wealth over a century ago. He grew up very comfortably in Greenwich, Connecticut – an idyllic and affluent American town just over the border from New York. My father was the descendant of a prominent Swiss family that made its mark during the turn of the century in wheat harvesting, grain elevators, real estate and other business interests. My father had a very comfortable life, attending the right schools, living in the right town and being afforded all the privileges of wealth.

Sadly, the one thing he did not have was a method of centralized oversight over the management of his wealth. My father and his advisers had no way of understanding or managing the collective risks he was assuming in the investment choices that his multiple investment managers were taking on his behalf. That lack of oversight ultimately led to the destruction of our family’s wealth, and with it the legacy and unity of our family. The loss of wealth has an inherent and profoundly destructive nature and I do not want anyone to experience what my family went through.

As the third-generation beneficiary of a family fortune my father did not take an active role overseeing the assets that had been amassed or the managers that were being paid to manage the assets. In the 1980s my father’s advisers were all doing what most investment managers still do today, managing to the same asset allocation models, chasing the same risk strategy in hopes of excess returns with zero accountability or participation in financial loss. In the course of one year, as markets shifted, my father’s wealth was gone. There was no recourse – each adviser was individually doing the right thing, though unfortunately they were all doing the same thing which my father was blind to. He lacked a consolidated view of his holdings.

We fell into dire financial straits and no one should experience what I did as a teenager. My family’s story is not unique. It has been reported that roughly 90% of wealth gained in one generation will be lost by the third. We lost more than money. Our financial challenges led to my parents’ divorce and no doubt played a role in what became my brother’s struggle with addiction that ultimately took his life last summer.

I still remember at age 16 working as a landscaper during the day and clearing tables as a bus boy at night. I worked every minute I could and earned a few thousand dollars which at the time I thought was all the money in the world. I was so happy watching the balance in my bank account grow. But those savings were needed for more important purposes, and I could tell it broke my father’s heart when he asked me, his youngest son, for the money I earned in order to pay rent.

The one thing I learned is that those who inherit wealth often lack the ability or nature to rebuild wealth. My father is smart, strong and proud, but he lacks the ability or – more importantly – the burning drive that his ancestors had to create wealth. Handing my father my entire savings from that summer was the first time I cried in many years. In some ways it broke me and in some ways it made me the person I am today – focused with relentless determination, but equally empathetic. You do not know the true story behind a family unless you ask and listen. Listen to what you hear but also listen for the nuances in how the story is told, the inflection in the voices of the family members who tell the story, the comfort and discomfort as you learn about the events that lead a family to demand oversight over their wealth.

The Fintech Paradox

Amazingly, in 2020 a 25-year-old with $10,000 in savings has a multitude of tools and platforms at his or her disposal to track every penny spent and every dollar invested. Yet for those who have multi-generational wealth, for those who influence the world’s economies, there have never been such tools – until now.

According to Wealth-X, there are over 250,000 individuals who have $30 million or more in personal wealth controlling over $31.7 trillion in global investment power. This is the most concentrated and most powerful consumer segment on the planet, yet this segment remains unserved and reactive waiting for their quarterly reports from their multiple managers to tell them what happened to their wealth in the prior quarter.

The reason this market segment has not participated or benefited from the fintech revolution is because the inherent complexity of extreme wealth creates organic barriers to entry that prevents financial applications from adequately supporting this market. You need decades of experience working with hundreds of family offices across multiple continents to truly understand the root issue causing friction of information and action. There are numerous examples of fintech companies that had great intentions of serving ultra-high net worth families, but after burning through tens of millions and even hundreds of millions of dollars in capital they understood that in the ultra-high net worth segment it is experience and knowledge, not just capital, that determines longevity and success. I have been told on many occasions that our company has an unfair advantage because we have worked with more family offices in more countries longer than anyone else, and it is this collective experience that informs our approach to solving the structural issues that foster information friction and places great wealth at risk.

The Structural Solution: Data and Globalization

After spending two decades working for some of the largest and most respected financial software companies in portfolio management, asset allocation, trading, and family office reporting I learned that in order to drive a meaningful transformation in global finance a new system had to be created from scratch, built on lessons learned with a complete understanding of the capabilities required to empower wealth owners with the information they need to engage and control the destiny of their wealth.

Albert Einstein put it best saying we cannot solve our problems with the same thinking that created them. In order to truly transform global finance we had to focus on solving the industry’s structural challenges around data, globalization, operating efficiency/scale and security.

Solving the Globalization Challenge

Because private wealth is global, our system had to be global. Most systems built outside the United States do not support tax lot level information and the majority of systems built inside the United States do not support multi-currency transactions, at least not correctly. Our system solves the industry’s structural challenge of globalization by supporting the trade currency, settlement currency and base currency on every transaction at the time of the transaction, and allows users to select a reporting currency. In addition, our system can separate principal currency from income currency, and our currency calculation supports all 16 decimal points to eliminate rounding errors, providing more comprehensive and more accurate data for better control and decision making.

Solving the Data Challenge

To solve the challenge of data we knew we had to capture more data than other systems, so we have taken the time and made the investment to build proprietary data connections to major banks throughout the world which has allowed us to capture more data than other systems. Our platform has over three times more transaction codes than other systems so we can process every component of every transaction in every asset class across every currency. From equities, fixed income, private equity, currencies and hedge funds to complex bank loans, derivatives, art and real estate Private Wealth Systems captures, corrects, calculates and presents meaningful intelligence so wealth owners know who and what is driving risk, return, income and expense.

Precision, Efficiency, and Scale

Although capturing and correcting data is critical, it must be done with hyper-efficiency and operating scale. Ultra-high net worth individuals need information that is tax level accurate, comprehensive enough to support their entire balance sheet regardless of the type of investment, currency or ownership structure, and timely enough to be relevant and actionable.

Historically, the few family offices that did attempt to create a consolidated view of their balance sheets relied on large operations teams and manual effort to manage the data. The problem is that manual effort is not scalable, is error prone and is very expensive over the long term especially when considering training costs and operational security. To solve the industry’s structural issue with scale we ensured our system was hyper-efficient for processing data without sacrificing quality or comprehensiveness. For example, one reconciliation analyst on our system can support 8.3 times more transactions than other systems in our industry.

We took the time to build a proprietary accrual calculator that supports all day count basis across all instruments and jurisdictions so we can calculate total market value each day systematically without requiring manual entry from month-end statements, providing values and performance calculations that are more timely and more accurate for better decision making without operational burden. Our efficiency allows us to provide more data, faster, more accurately at a lower total cost for even the most complex wealth.

Client Case Studies and Personalization

The following client case study demonstrates our differentiation – a multi-billion dollar family office hired one of the largest accounting firms in the world to perform a global search for a system that could support their complexity across financial instruments, currencies and complex partnership structures. After reviewing 22 systems across the Americas, Asia and Europe, the family selected Private Wealth Systems. A year after enrolment the family hired an accounting firm to perform a transaction level audit of their data on our system. We proved that we systematically matched back to each system of record across all custodian banks and private investment managers.

We are working with another family office that did not know they had direct exposure to seven emerging currencies until they enrolled onto our platform. Another example is a family that has over 400 holdings in a single account and 10% of those holdings have market values under $500 highlighting the fact that the account is not being managed efficiently. Wealth owners must engage and take an active role in how their wealth is managed.

Infinite Personalization and Security

Because ultra-high net worth individuals are by nature very exacting, we created a data model unlike any data model in the industry, enabling individuals to create their own personal attributes at the holding level for infinite personalization but with global scale. Private Wealth Systems empowers each individual with the ability to classify, structure and format their data any way they want whenever they want – true personalization at scale.

Of equal importance is data privacy and personal security. Because we work with several of the top global private banks in the United States and Europe, we must adhere to the collective cyber-security and operational security protocols of the world’s largest banks. Personalization also drives engagement because people will want to interact with data on their terms.

To help facilitate active engagement we have developed an enhanced design that can support the most sophisticated financial professional while equally informing someone with little to no financial sophistication at all. To help our clients who have balance sheets over 100 pages long engage with their data, we enable them to start at a summary view and drill all the way down to individual tax lots. For example, you can view performance or allocation at the entity level across 20 related or unrelated entities. You notice one entity had a material change in market value or performance, so you click on that entity and drill down to see performance across all the managers for that entity. You then see the increase in performance is from Goldman Sachs and JP Morgan, so you drill through Goldman Sachs and JP Morgan to see which accounts, styles or strategies drove the performance, and you then see which holding or holdings contributed to the performance gains taking into account volatility, risk and fees. We are making complex data more manageable regardless of financial sophistication.

The New Financial Paradigm

Again, the purpose of our platform is to empower wealth owners to gain oversight and take control over their financial destiny. We are supporting family offices that are becoming more sophisticated and are starting to offer services that are banking related. For example, more family offices are starting to make direct investments and offer special purpose vehicles to offer their investment expertise to other family offices. We are working with families that are creating internal loan products using cash from Entity A to create a loan for Entity B. This trend will continue and foundationally change global finance.

The industry’s trillion-dollar question is what does an empowered consortium of ultra-high net worth individuals with a collective $31.7 trillion in global wealth and dominant expertise in building new business models mean to the established banking, wealth and asset management industries? Who can serve unbanked markets such as India faster and more efficiently – a large commercial bank that requires regulatory approval and massive infrastructure, or a consortium of ultra-high net worth individuals who have the capital and network to create, distribute and manage financial products and services in India and around the world?

Whatever the future holds, our team is determined to help drive meaningful transformation with our digital infrastructure that will eliminate the risks associated with friction of information and action that exist across global finance today.

About the Author

Craig Pearson, CFA is the CEO and co-founder of Private Wealth Systems. With the backing of three prominent family offices, Craig started Private Wealth Systems intent on solving the structural industry challenges that continue to plague legacy software systems and the global financial services industry in terms of data capture, data processing and data presentation. Beginning his career as an investment banker and later transitioning into financial technology, he has held leading positions at several of the largest fintech companies with direct experience in trade order management, multi-asset portfolio management, compliance and reporting. Private Wealth Systems is now the industry leader in delivering multi-asset, multi-manager, multi-currency consolidated financial intelligence to family offices across four continents. Craig is a Chartered Financial Analyst (CFA) and holds a master’s degree in finance.