Social investing has become a universal theme, yet the practical application remains as personal as the individual. Where one investor may demand the exclusion of fracking from all of their portfolios, another investor may want increased exposure. Climate control, human rights, adherence to religious guidelines, and over thirty other socially responsible themes all impact not just how wealth is managed, but also the trusted relationships that exist between investors and their advisors.

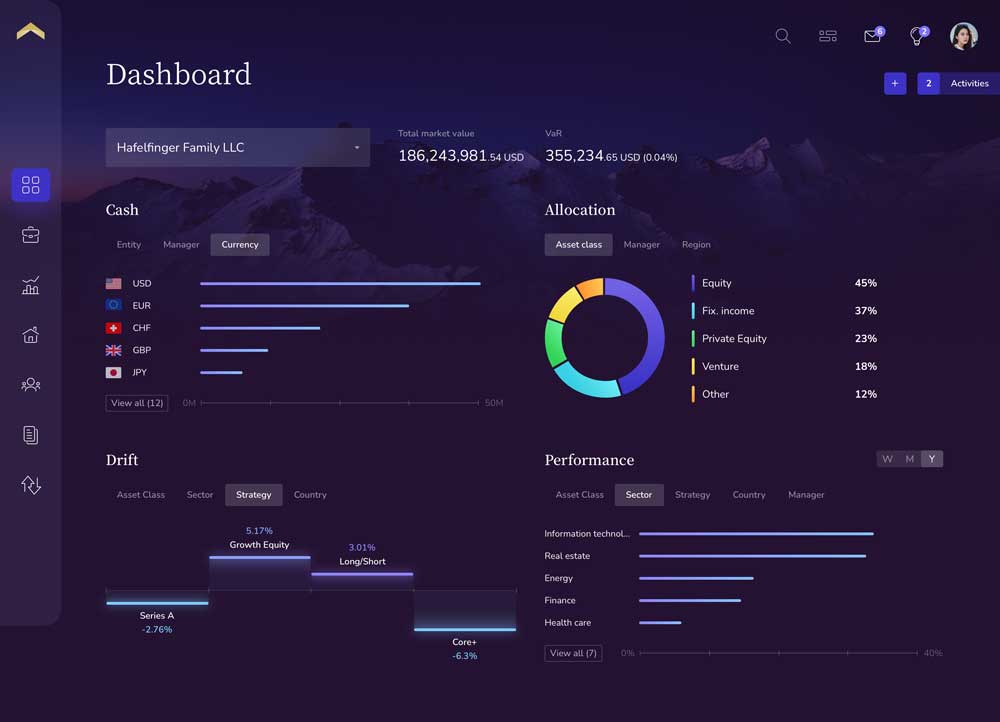

Recent advancements in technology have enabled a new breed of consolidated investment reporting platforms that incorporate environmental, social and governance (ESG) analytics, to become the true digital disruptor that is changing the way private wealth is managed. With a single touch on a mobile device, investors and their advisors now have unprecedented access, understanding and oversight over their total wealth, including the ability to consolidate and analyze all accounts across all managers in all asset classes and complex entity structures. Individual investors are beginning to take control of the power paradigm and drive the conversation around socially responsible investing, helping their advisors construct portfolios and allocation strategies that align their uniquely individual values with their investment portfolios. Consolidated reporting allows investors and their advisors to understand the aggregated portfolio’s total ESG score and compare that score to personal benchmarks or drill further down to view ESG scores by manager, by country, by sector, and by account right down to individual public and private securities, and to do so in context of total performance and risk in order to make the most informed investment decisions.

| Consolidated investment reporting with ESG Analytics is becoming the digital disruptor that is reshaping how private wealth is managed. |

Traditionally, investors judged performance based solely on benchmarks and basis points. That’s changed with the proliferation of social media. This channel brings instantaneous attention to global environmental, social, and governance concerns—a shift that has inspired a growing number of ultra-high net worth investors, particularly GenXers and Millennials, to define investment success in terms of ESG-weighted performance. Beating an index by a few basis points means little if doing so violated an individual’s personal ethos. For individual investors who are focused on socially responsible investing, they are equally concerned about making choices that influence both their financial objectives as well as their social goals. The ability to leverage private wealth to influence how businesses operate will have a growing and profound impact on the global financial system for years to come.

Socially responsible investing is an undeniable and increasingly formidable trend. The United Nations’ Principles for Responsible Investment (PRI) has grown to over $34 trillion in assets since its 2006 launch. Superior investment returns are helping to drive this growth. In an 18-year Harvard Business School study published in 2012, companies with high sustainability programs achieved above-market returns that were 4.8% higher than their counterparts with low sustainability performance, and with lower volatility. But the true driver of SRI adoption is the growing trend among investors in the private wealth segment to measure their personal significance not by the amount of wealth they possess, but rather by what they do with that wealth.

Here are two examples of how SRI is quickly reshaping private wealth management:

- Susan is a successful entrepreneur who works with several

investment managers and private banks to manage her wealth. She reads an article on the effects fracking

has on the environment, and she wants to understand her total exposure to this

segment. From her iPad, Susan identifies

fracking as an ESG issue, then views which companies within her portfolios are

associated with fracking. She can also see if any particular investment manager

has overweighed fracking. She contacts

her advisors to discuss reducing or excluding fracking from her portfolios,

taking into account the expected performance and associated risks of her

decision.

- Mark, an advisor, has a new client that permissioned Mark to view all of her investments across all managers for better oversight of her wealth. After running an ESG screen for the themes that are most important to his client, Mark learns that one of his client’s managers allocated 3% of her portfolio to countries that have a poor track record on human rights. Knowing this is an important issue for his client, Mark proposes a new set of investments that are more aligned with his client’s personal values and, in doing so, is trusted with a greater share of his client’s assets to manage.

Using innovative new technologies, investors are gaining an unprecedented level of personal empowerment and fulfilling their promise of purpose. These same new technologies are enabling advisors with the visibility they need to deliver a truly personalized level of service to their clients.

Craig Pearson, CFA, is co-founder and CEO of Private Wealth Systems, an industry-defining financial technology company that provides consolidated investment reporting solutions to sophisticated investors and their advisors. www.privatewealthsystems.com