For decades client reporting was defined by its role as a back office burden with a singular purpose of meeting regulatory requirements.

However, client reporting has evolved to become the most powerful communication medium that binds the investor/advisor relationship. This shift in purpose is driven by the most foundational element of the human condition, the quest for knowledge. It is our collective need for knowledge that is forcing the redefinition of the industry’s intended purpose – to provide meaningful, relevant, actionable intelligence with transactional level transparency. Leading this transformation is a new breed of reporting platforms that remain committed to the cause of transparency, clarity, and personalization at a level that was unimaginable even a year ago. This next generation of client reporting will, by its very mandate, democratize information and establish a new equilibrium of power that will be shared by – and benefit – both investors and advisors alike in the growth and preservation of $52trn in global private wealth.

The client reporting industry’s inflection point was driven by the 2008 financial crisis when the lack of instantaneous access and understanding, for both investors and their advisors, created a crisis in confidence across the financial ecosystem. Basic questions including; what is an investor worth across all of their managers and asset classes, what risk did a specific investor or group of investors have to a single security, custodian, country, strategy, style or asset class, or simply which managers performed well and which did not, remained unanswered. Worse yet, the more complex the wealth the more opaque the answers remained.

CLIENT REPORTING HAS EVOLVED TO BECOME THE MOST POWERFUL COMMUNICATION MEDIUM THAT BINDS THE INVESTOR/ADVISOR RELATIONSHIP

CRAIG PEARSON, CFA, PRIVATE WEALTH SYSTEMS

LOOKING FOR ‘THE ONE’

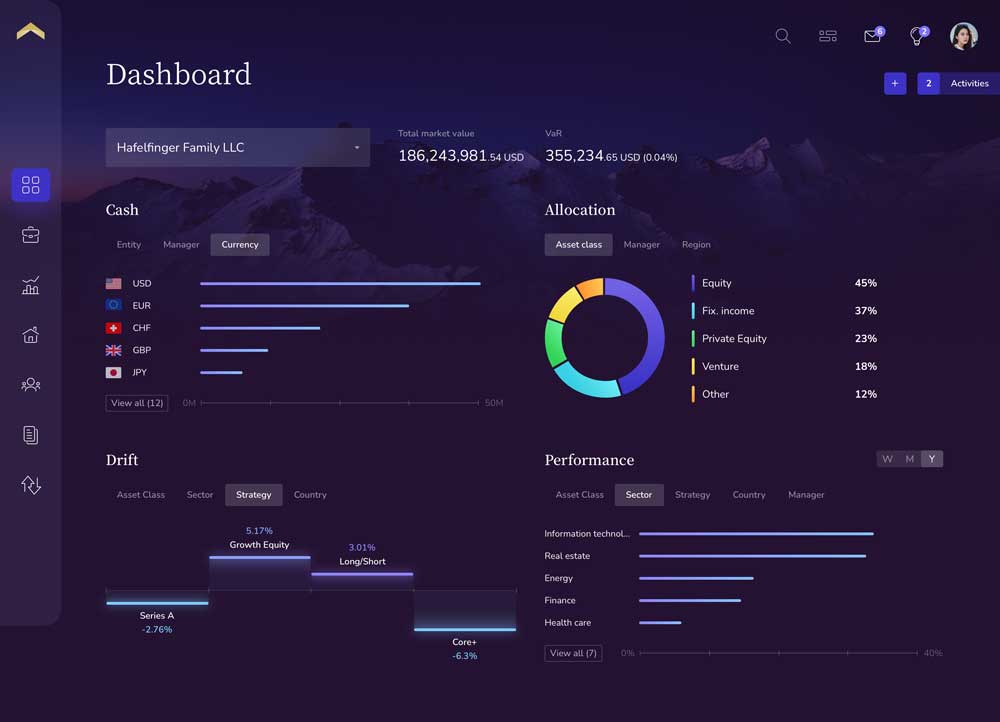

The promise of consolidated reporting is to have a single instantaneous view of all key performance indicators that identify what is driving risk, return, income and expense across complex portfolios; capturing, consolidating, cleansing, calculating, and presenting data that takes into consideration all transactions in all accounts across all custodians, managers and sub-managers – regardless of asset class, country or currency.

However, the search for the one platform that fulfills this promise is continuous and evolutionary. In January 2015 the reporting industry begun its third evolution, which is already showing great promise in fulfilling its mandate as domain expertise, capital, and driving market needs come together to support the prolific complexity that advancements in global financial markets continue to produce.

The first generation of consolidated reporting platforms, built between 2000 and 2010, were born out of an immediate need to provide a complete wealth report for a single client or small group of client accounts. These platforms were focused on creating summary reports for client meetings and not the technology or the business processes to produce those reports.

Based on limitations in technology at that time, these first generation platforms forced users to perform shadow accounting, duplicating the data and efforts of their client custodial systems of record. Unfortunately, any redundant process by its very nature drives costs up, drives data quality down, and extends delivery times to unacceptable levels. The purpose of consolidated reporting is to provide actionable intelligence, but receiving a report weeks or months late with errors renders those very reports meaningless or even harmful. This is why the first wave of consolidation among first generation platforms has begun.

Second generation platforms, built between 2010 and 2014, approached the problem with a greater focus on user design and scalable technologies, and less so on data quality. Although these platforms can scale, the foundational elements of second generation platforms were not built by individuals with domain expertise, and as such these systems often produce data that is not accurate. Participants across the private wealth industry continue to state that design is a “nice to have,” but if the data isn’t accurate it renders the platform unusable. Many believe second generation platforms will either seek consolidation or redeploy their technology in adjacent areas of the financial services industry.

This new, third evolution of client reporting platforms, which are just now coming to market, is a more evolved and learned approach to bringing true transparency and actionable intelligence to those who need it most. With the maturation of account aggregators capturing data is no longer manual or difficult. It is the processing, cleansing, calculating, and presenting of that data that determines success or failure. Of noted importance, these new reporting platforms are designed by those who possess dominant domain expertise in data structure, data processing and core calculation logic. These platforms differentiate themselves by using refined calculation logic that produces superior data quality on a consistent basis, a unique data model that supports a level of personalization that before now was unimaginable, and an elegant distinctive design that is reflective of its sophisticated user base. These platforms not only support complex ownership structures and investment instruments, but they re-imagine the definition of transparency by enabling each individual, whether investor or advisor, to create custom attributes across securities, accounts and entities so wealth can be managed based on how each individual views their financial universe. This capability impacts asset allocation models, risk analysis, planning and general advice, allowing advisors to not only communicate but also illustrate their strategy and differentiation based on the personalized advice they provide to each individual client. Of equal importance, this third evolution is leveraging advancements in technology to scale their systems to support all levels of wealth, including complex family offices and millions of less complex mass affluent clients – a single solution to meet the varying needs of today’s wealth managers.

PRESERVING WEALTH

By re-defining the very purpose of client reporting, this new next generation of client reporting platforms will fulfill their promise and hold true to their bedrock belief that all investors, regardless of complexity, will have instantaneous access to accurate, comprehensive, timely, and personalized information. Client reporting remains focused on becoming the enabling technology that facilitates elevated and informed communications between investors and their trusted advisors to help preserve the very wealth they have spent a lifetime to build.